Who Should Actually Get the Chase Sapphire Preferred?

If you’ve been looking into credit cards with solid rewards in the U.S., you’ve definitely come across the Chase Sapphire Preferred.

Advertisement

It’s not the fanciest card out there, and it’s not the most basic either—but it hits a nice sweet spot between valuable perks, real travel rewards, and a yearly fee that’s actually manageable.

Advertisement

In this guide, we’re going to walk you through everything you need to know about the Chase Sapphire Preferred in 2025: how it works, what it offers, how to earn and use points, and whether it’s even worth it for your lifestyle. Let’s get into it.

How to Apply for the Chase Sapphire Preferred

Ready to get your hands on the Chase Sapphire Preferred? Good call. The application process is super simple and can be done entirely online—no need to go to a bank or talk to anyone on the phone.

Advertisement

Here’s exactly what you need to do:

- Head over to the official Chase website.

You can apply directly through their secure portal.

Apply here - Fill out the online form.

They’ll ask for basic info like your name, address, Social Security number, income, and how much you usually spend with credit cards. - Submit your application.

Some people get approved instantly, others might need to wait a few days if Chase wants to verify more info. - If approved, your card will be shipped out.

It usually arrives within 5 to 10 business days.

Try not to apply if you’ve recently opened several credit cards. Chase is picky with something called the “5/24 rule”—if you’ve opened 5 or more personal credit cards in the past 24 months, they’ll likely deny your application, even if your credit is good.

So, if you’ve kept your credit in check and haven’t gone wild opening new cards lately, you’ve got a solid shot.

What Is the Chase Sapphire Preferred and Why Is It So Popular?

The Chase Sapphire Preferred is a rewards credit card designed for folks who travel—or at least want to get rewarded like they do.

You earn points that can be redeemed for travel, cashback, gift cards, or even transferred to airline and hotel loyalty programs. All of this happens through Chase’s Ultimate Rewards program, which is one of the most flexible around.

Why is it so popular? Because it gives you a strong mix of travel perks, a solid welcome bonus, and doesn’t charge an insane annual fee. It’s basically the perfect “middle ground” card between no-frills and luxury cards.

What Are the Main Benefits of the Chase Sapphire Preferred?

The Chase Sapphire Preferred isn’t just another points card — it actually brings real value if you like to travel, dine out, or even just spend smart. It’s one of those rare credit cards that balances solid rewards with a manageable annual fee.

Here’s a breakdown of the main perks you’ll get with it:

Earn Points on the Stuff You Actually Spend Money On

- 5x points on travel when you book flights, hotels, or car rentals through the Chase Ultimate Rewards portal

- 3x points on online grocery orders (excluding Walmart/Target) and select streaming services like Netflix, Hulu, and Disney+

- 2x points on restaurants and eligible food delivery (like DoorDash or Uber Eats)

- 2x points on other travel purchases (even when you book outside the Chase portal)

- 1x point on everything else, so every dollar still counts

This makes it a great “everyday” card that works whether you’re grabbing takeout, planning your next trip, or just doing weekly shopping online.

Your Points Are Worth More for Travel

This is where the Sapphire Preferred really stands out:

When you use your points to book travel through the Chase Ultimate Rewards portal, they’re worth 25% more.

So if you have 60,000 points, that’s not just $600 — it’s $750 in travel value. It’s a simple way to boost your rewards without needing to be a travel hacking pro.

Built-In Travel and Purchase Protection

The card also comes loaded with protections that many cards in this price range just don’t offer:

- Trip cancellation/interruption insurance: If you get sick or your flight gets canceled for a covered reason, you could get reimbursed for non-refundable expenses (up to $10,000 per person).

- Primary auto rental insurance: Skip the pricey insurance at the rental desk — this card covers collision damage when you rent a car and decline the rental company’s coverage.

- Purchase protection: If an item you bought is stolen or damaged within 120 days, you may be reimbursed (up to $500 per claim).

- Extended warranty: Adds extra time to manufacturer warranties on eligible purchases.

No Foreign Transaction Fees

Traveling abroad? Unlike many credit cards that hit you with a 3% fee every time you swipe overseas, the Sapphire Preferred lets you use your card worldwide with no foreign transaction fees. That’s a must-have if you travel internationally, even once a year.

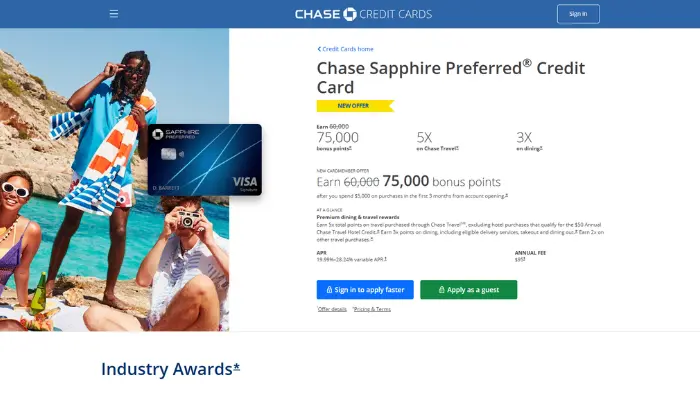

What’s the Welcome Bonus and How Can You Get It?

This is the fun part. The Chase Sapphire Preferred usually comes with a pretty generous welcome bonus. In 2025, it’s commonly:

60,000 points after spending $4,000 in the first 3 months.

What does that mean? Those points are worth around $750 if used for travel through the Chase Ultimate Rewards portal. And if you’re savvy and transfer them to partner airlines, you might stretch that value even further.

Here’s how to make sure you qualify:

- Apply online through the Chase website.

- Spend $4,000 in the first 90 days (regular purchases only).

- Points will be credited to your Ultimate Rewards account.

One big tip: don’t overspend just to hit the bonus. Plan your purchases wisely and always pay in full to avoid interest charges.

How to Earn Points with the Sapphire Preferred

If your goal is to get the most out of the Chase Sapphire Preferred, it all comes down to how you use it. The card is built to reward the kind of spending most people already do — like eating out, streaming, grocery shopping online, and booking travel.

The more you line up your everyday spending with the bonus categories, the faster those points pile up.

Here’s how the points break down:

- 5x points on travel purchases made through the Chase Ultimate Rewards portal (flights, hotels, rental cars)

- 3x points on eligible online grocery purchases and select streaming services (like Netflix, Hulu, and Disney+)

- 2x points on restaurants and food delivery (both in-person and through apps like DoorDash or Uber Eats)

- 2x points on general travel purchases — even if you don’t use the Chase portal

- 1x point on everything else — because every dollar still counts

Whether you’re booking a weekend getaway or just grabbing takeout, your purchases are working for you in the background.

Want to earn points even faster? Try this:

- Use the Sapphire Preferred for all dining and delivery — skip the debit card and swipe this instead

- Book travel through Chase’s site — that 5x multiplier adds up quickly if you fly or stay in hotels

- Use it for big monthly bills, like your phone, internet, or even insurance (if accepted)

- Know the bonus categories — not everything counts, so it helps to double-check what’s eligible inside your Chase account or app

Even if you’re not traveling every month, small habits can still lead to big rewards. Over time, those points can turn into free flights, hotel stays, or even cashback — and all you did was use the right card at the right time.

How to Use and Redeem Your Points

So you’ve been racking up points with your Sapphire Preferred — now what?

The good news is that Chase gives you plenty of ways to use your points, and you don’t need to be a travel hacker to get serious value out of them.

Everything is managed through your Chase Ultimate Rewards account, which you can access online or in the mobile app. It’s user-friendly, and you can track your points, check their value, and redeem them in just a few clicks.

Here’s how you can redeem your points:

- Travel through Chase Ultimate Rewards:

This is where your points shine. When you use them to book flights, hotels, rental cars, or cruises directly through Chase’s portal, your points are worth 25% more. That means 60,000 points equal $750 in travel — not just $600. - Cashback:

If you’d rather get your points as money in your pocket, you can redeem them for statement credit or direct deposit. Each point is worth one cent this way — simple and flexible, but not as high-value as using them for travel. - Gift cards:

You can trade your points for gift cards from major retailers like Amazon, Walmart, Best Buy, and many others. Sometimes Chase even runs promos where certain gift cards cost fewer points, which boosts the value. - Pay with points at checkout:

Use your points to pay directly at select online retailers (like Amazon), although this usually gives you the lowest value per point — so it’s better used in a pinch. - Transfer to travel partners:

This is where the real magic happens. Chase has a list of 1:1 transfer partners, including airline and hotel programs like United, Southwest, JetBlue, Air Canada, Hyatt, and Marriott. You can transfer your points to these programs and book directly with them — and sometimes score flights or hotel stays worth way more than the standard value.

If you’re willing to do a bit of digging and are flexible with your dates, transferring points to airline or hotel partners can easily double the value of your points. Especially during promotions or off-peak times, you can get serious bang for your buck.

Bottom line? Whether you want to keep it simple with cashback or go big with free flights and hotel nights, the Chase Sapphire Preferred gives you options — and real flexibility to make your rewards work for you.

How to Use and Redeem Your Points

Once you’ve built up some points with your Sapphire Preferred, using them is easy — and depending on how you redeem, they can be worth even more.

Here are your main options:

- Book travel through Chase Ultimate Rewards — Your points are worth 25% more here. That means 60,000 points = $750 in flights, hotels, or car rentals.

- Transfer to travel partners — You can move your points 1:1 to programs like United, Southwest, or Hyatt. This often gives you the highest value, especially during deals.

- Cashback — Want the money? Redeem points for statement credit or bank deposit at 1 cent per point.

- Gift cards — Use points for cards from brands like Amazon, Walmart, and Best Buy. Simple and flexible.

- Pay with points at checkout — Available with some retailers, but usually not the best value.

Quick tip: If you’re aiming for the biggest return, transferring to travel partners is where your points can stretch the farthest.

What Are the Requirements to Get Approved?

The Chase Sapphire Preferred isn’t one of those entry-level cards you can grab when you’re just starting out. Chase expects you to already have a solid credit profile — and they’re a bit picky about who gets in.

Before you apply, here’s what they usually want to see:

- A good to excellent credit score (typically 670 or higher)

- A steady, reliable income

- No other Sapphire card currently open (you can’t have both the Preferred and the Reserve)

- You haven’t received a Sapphire welcome bonus in the last 48 months

If you’re still building your credit or just opened a bunch of cards recently, it might be better to start with something more basic and work your way up. This one’s best for people who already have a bit of credit history under their belt.

What Are the Downsides of the Chase Sapphire Preferred?

Like any card, the Sapphire Preferred has its flaws — and it won’t be the right fit for everyone. If you’re not someone who travels at least occasionally or doesn’t care much about earning points, the perks might not feel all that useful.

Here are a few downsides to keep in mind:

- The $95 annual fee can feel like a waste if you rarely travel or eat out

- You’ll need to spend consistently in the bonus categories to get real value

- It doesn’t offer airport lounge access — that’s a Reserve-level perk

- The Chase travel portal isn’t the smoothest experience for some users

If you prefer a simpler, no-fuss card with no annual fee, there are definitely other options that might suit your lifestyle better.

Who Should Consider This Card in 2025?

The Chase Sapphire Preferred isn’t for everyone — but if you fall into the right group, it can be one of the most valuable cards in your wallet. It hits a sweet spot: good rewards, solid travel perks, and a reasonable annual fee. No over-the-top luxury stuff, but definitely not basic either.

This card makes the most sense for people who:

- People who travel once or twice a year

- Anyone who dines out regularly or orders food delivery

- Folks who want travel rewards without the high cost of premium cards

- Users who are comfortable managing points and maximizing value

If none of those sound like you, no problem. There are plenty of other solid options out there.

The Chase Sapphire Preferred is one of those rare cards that actually delivers on its promises. You don’t need to be rich or fly every week to benefit from it. But if you travel once or twice a year, like to eat out, and want to turn your spending into real rewards, this card’s a solid move.

Just remember to use it smartly—pay it off in full, hit that welcome bonus, and redeem your points wisely.

So what do you think? Is this the right card for your wallet?