Is the Wells Fargo Reflect Worth It? Discover the Pros and Cons

If you’re looking for a credit card that offers simple and easy-to-understand benefits, the Wells Fargo Reflect might be the perfect solution for you.

Advertisement

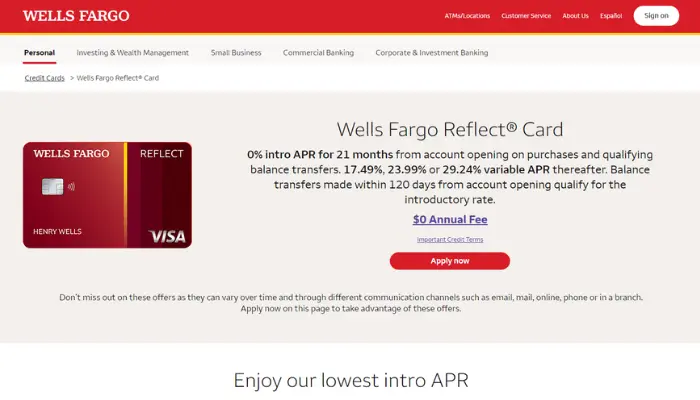

It’s known for its introductory 0% APR (Annual Percentage Rate), which can be a real lifesaver for those who want to save on interest or need some time to get their finances in order.

Advertisement

In this article, we’ll break down everything about it: how it works, what the costs are, and even some tips to make the most of it.

What is the Wells Fargo Reflect?

The Wells Fargo Reflect is a credit card designed for people who want to better manage their spending and avoid high interest rates.

Advertisement

It’s especially recommended for those with financial plans in mind, like paying off debts with higher rates or making a large purchase without worrying about interest for a while.

This card isn’t loaded with points, miles, or cashback — the star here is the 0% introductory APR, which can last up to 21 months (seriously, over a year and a half!).

This means that during this period, you won’t pay interest on purchases or balance transfers, as long as you make the minimum payments on time. It’s ideal for those looking for some relief on their bills or needing time to reorganize their financial life.

Main Benefits of the Wells Fargo Reflect

If you’re looking for a card that combines savings, simplicity, and practicality, the Wells Fargo Reflect might be exactly what you need.

It stands out for offering clear and useful advantages, especially for those who want to avoid interest and have greater control over their finances. Here are the main reasons why this card is a smart choice:

- Introductory 0% APR: Up to 21 months without paying interest, with 18 months guaranteed and an extra 3 months if minimum payments are made on time.

- No annual fee: Unlike many cards on the market, you don’t pay anything to keep the Reflect active.

- Financial management tools: The Wells Fargo app helps you track expenses and manage payments in a simple and practical way.

- Consumer protection: Benefits like Cell Phone Protection and fraud monitoring are included at no extra cost.

How Does the Introductory APR on the Wells Fargo Reflect Work?

One of the biggest advantages of the Wells Fargo Reflect is its 0% introductory APR, which can provide significant financial relief.

However, to make the most of this benefit, it’s essential to understand how it works and what the rules are. Let’s break it down in simple terms for you:

- What is APR?

APR stands for “Annual Percentage Rate,” and it’s essentially the interest you pay if you don’t pay off your credit card balance in full. With the Wells Fargo Reflect, this rate starts at 0% for a limited period. - How long does the 0% offer last?

You’re guaranteed 18 months of 0% APR, and you can earn an extra 3 months, totaling 21 months, as long as you make at least the minimum payment each month. - What happens after the introductory period?

Once the promotional period ends, the standard APR applies. This can range between 17.99% and 29.99%, depending on your creditworthiness.

Smart tip: Use this period to pay for large purchases or transfer balances from other cards with high interest rates. Just make sure to keep up with your payments to maintain the offer!

Fees and Associated Costs

While the Wells Fargo Reflect is attractive due to its 0% introductory APR, it’s important to know the fees and associated costs to avoid surprises.

After all, understanding these charges helps you use the card more effectively. Here’s what you need to know:

- Annual Fee: Zero!

You don’t pay anything to keep the card active, which is already a saving compared to many cards on the market. - Balance Transfer Fee:

During the first 120 days after opening your account, you’ll pay 3% (or a minimum of $5) for each balance transfer. After this period, the fee increases to 5%. - Foreign Transaction Fee:

If you use the card outside the U.S. or on international websites, you’ll be charged 3% of the purchase amount. - Late Payment Fees:

Late payments can cost up to $40 and may also cancel your 0% introductory APR. So, it’s crucial to stay on top of your payments to keep the benefits intact.

Important Tip:

If you plan to transfer balances or use the card while traveling, factor these fees into your budget. Careful management helps avoid unpleasant surprises on your statement!

How to Apply for the Wells Fargo Reflect

If the Wells Fargo Reflect seems like the perfect card for your needs, the next step is to apply. Fortunately, the process is quick and straightforward, with no complicated red tape.

Just follow a few simple steps, and in no time, you could be enjoying the benefits of this card. Here’s how to get started:

- Check Your Credit

The Wells Fargo Reflect is best suited for those with good to excellent credit. Before applying, use free credit-check tools to verify your score. - Visit the Wells Fargo Website

Go to the official website and find the Wells Fargo Reflect card page. - Fill Out the Application

Provide your personal information, such as name, address, annual income, and Social Security Number (SSN). - Review and Submit

Double-check that all information is accurate, then submit your application. - Wait for Approval

In some cases, approval is instant. If additional information is needed, Wells Fargo will contact you.

Strategies to Use the Wells Fargo Reflect Effectively

If you really want to make the most out of the Wells Fargo Reflect, it’s essential to use it strategically.

This card can be a great tool for saving money, but that depends on how well you manage its benefits and avoid common pitfalls.

Here are some practical tips for using the card wisely:

1. Plan Large Purchases

Take advantage of the 0% APR period to finance important items, such as:

- Furniture for your home;

- Electronic equipment;

- Unexpected medical expenses.

With the 0% APR, you can spread out payments without paying interest, as long as you make the minimum payments on time.

2. Transfer Balances from Other Cards

If you have high-interest debt on other cards, transfer the balance to the Wells Fargo Reflect within the first 120 days, when the transfer fee is 3%.

This helps you save on interest while paying off the debt during the 0% introductory period.

3. Avoid Late Payments

Losing the 0% APR due to a late payment can be very costly. Set up reminders or activate alerts in the Wells Fargo app to ensure your bills are paid on time.

4. Don’t Overspend

It’s tempting to spend more when you know you won’t be paying interest for a while, but this can become a trap. Use the card responsibly, focusing on planned and necessary purchases.

With these strategies, the Wells Fargo Reflect can become a financial partner that helps you save money and reach your goals without headaches.

Wells Fargo Reflect: Is It Worth It?

If you’re looking for a straightforward card with no annual fee and a generous introductory APR offer, the Wells Fargo Reflect could be an excellent choice. It’s perfect for those who want to save on interest, especially for large purchases or balance transfers.

On the other hand, if you prefer cards that offer cashback or travel points, the Reflect might not be the best option for you.

The Wells Fargo Reflect is a card that doesn’t come with a lot of frills, but it delivers on its promise: it helps you save on interest and offers practical tools to manage your finances.

If you’re trying to boost your budget or pay off debts faster, it’s definitely worth considering.

Now it’s up to you: explore your options and choose the card that best fits your lifestyle.