Wells Fargo Active Cash: Your Ticket to Unlimited Cashback

If you’re looking for a credit card that simplifies your life and still gives you real rewards, the Wells Fargo Active Cash might be just what you need.

Advertisement

It’s a popular choice for those who want hassle-free cashback and advantages that truly make a difference in everyday life.

Advertisement

Let us show you everything about this card: from its benefits to how it works and whether it’s worth it for your wallet. Let’s dive in!

What is the Wells Fargo Active Cash?

The Wells Fargo Active Cash is a credit card from Wells Fargo, one of the largest banks in the United States. It stands out because it offers 2% cashback on all qualifying purchases.

Advertisement

This means that as you use the card for your everyday expenses, a portion of your money comes back to you. There are no tricks or complicated categories—it’s simple and straightforward.

If you want a card that requires no effort to understand how to accumulate rewards, this is ideal. Whether you’re shopping for groceries, paying bills, or even making larger purchases, the Active Cash puts money back in your pocket.

Main Benefits of the Wells Fargo Active Cash

Let’s be honest: no one wants a credit card that’s just another bill to pay without giving anything in return, right? That’s exactly why the Wells Fargo Active Cash stands out.

It not only simplifies your financial life but also puts money back in your pocket with every purchase. Want to know why so many people choose this card? Check out the benefits that make it one of the best options on the market:

1. 2% Simple and Fast Cashback

The big advantage of this card is its cashback program. With it, you earn 2% back on nearly every purchase you make.

It doesn’t matter if you’re buying a snack, filling up your car, or paying a subscription—your purchases generate rewards.

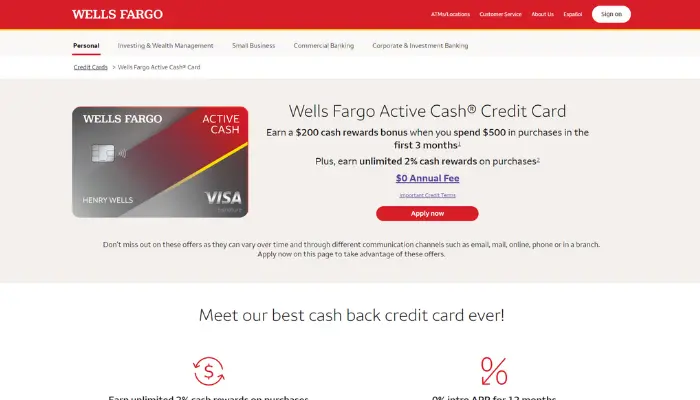

2. Initial Bonus Offer

Who doesn’t like to start off on the right foot? The Wells Fargo Active Cash offers an initial bonus for new customers.

Generally, you need to spend a specific amount within the first three months to unlock the bonus. It’s like getting free money just for starting to use the card.

3. No Annual Fee

Annual fees? Forget about it! With the Active Cash, you pay nothing to keep the card. It’s zero annual fees forever.

4. Promotional Interest Rate

Another interesting point is the promotional APR of 0% for 15 months on purchases and balance transfers. This means you can make larger purchases or consolidate debts without paying interest during this initial period.

Who Should Consider the Wells Fargo Active Cash?

The Wells Fargo Active Cash is a great option, but like any credit card, it’s not perfect for everyone.

However, if you value simplicity, want to avoid unnecessary fees, and are looking for an easy way to earn cash back while making everyday purchases, this card might be just what you need.

Check if it’s a good fit for you:

- Hassle-free rewards: No complicated point systems or difficult-to-understand categories. It’s straightforward cash back on every purchase.

- No fixed costs: No annual fee, no headaches.

- Everyday use: The more you use it, the more you earn. It’s that simple!

If your goal is to turn your daily expenses into real financial rewards, the Wells Fargo Active Cash is a solid choice.

Fees and Charges Associated with the Card

Before getting excited about any credit card’s benefits, it’s crucial to understand the associated fees and charges. With the Wells Fargo Active Cash, the conditions are competitive and easy to grasp, which is always a relief.

Here’s what you need to know before applying:

- Annual Fee: Zero. That’s right, you don’t pay anything to maintain the card.

- Introductory APR: 0% for the first 15 months on purchases and balance transfers. A great option for those looking to consolidate debt or make larger purchases without worrying about interest in the beginning.

- Standard APR: After the promotional period, the interest rate will adjust based on your credit. It’s always a good idea to check the exact rate at the time of application.

- Balance Transfer Fee: For transfers made within the first 120 days, there’s a fee of 3% (or a minimum of $5).

These terms make the Active Cash both accessible and appealing for those seeking a reliable credit card. But remember: a credit card can be a powerful tool or a problem, depending on how you use it. Use wisely and always keep track of your spending!

Application Requirements

Now that you’re familiar with all the benefits, you might be wondering, “How do I get my Wells Fargo Active Cash?” Before anything else, it’s important to understand what’s needed to get approved.

Here are the basic requirements:

- Credit Score: Typically, the bank requires a good to excellent credit history, which means a score of 670 or higher.

- Required Documents: Have on hand a valid form of identification (such as a passport or driver’s license), proof of address, and financial information like your monthly income.

- Application Process:

- Online: The most convenient option is through the Wells Fargo website. Simply fill out the form with your information and submit it.

- In-Branch: If you prefer, you can also visit a Wells Fargo branch to apply in person.

Extra Tip to Increase Approval Chances

Before applying, take a close look at your credit report. Check if everything is in order and if there are no pending issues that could affect your chances.

If your score isn’t ideal, work on improving your finances, reducing debts, or resolving any late payments before applying for the card. This significantly boosts your chances of approval!

How Does the Rewards Program Work?

If you’re tired of complicated rewards programs, the Wells Fargo Active Cash is the perfect solution. The system is so straightforward that you don’t need any fancy strategies to make the most of it.

Everything revolves around the fixed 2% cashback on all purchases. No specific categories or confusing rules.

To make things even easier, you can track and redeem your rewards directly through the bank’s app or website. And the best part? There’s no limit to how much you can earn. The more you spend, the more you earn. Just use it, accumulate, and enjoy!

Here’s how the rewards program works step by step:

- Earn 2% on All Purchases: No matter what you’re buying, the cashback is always 2%.

- Track Your Rewards: Use the Wells Fargo app or website to see how much you’ve earned.

- Redeem Your Cashback: Use your rewards for:

- Statement credits.

- Direct deposits to a Wells Fargo account.

- Other benefits available in the program.

This cashback has no maximum limit, so the more you spend, the more you earn.

Security and Technology of the Wells Fargo Active Cash

Nowadays, with so many transactions happening online and in real-time, credit card security is essential. The Wells Fargo Active Cash does not disappoint in this regard.

It comes equipped with a range of modern tools that protect you from fraud and unexpected problems. Here’s how it ensures your peace of mind:

- Fraud Monitoring:

Receive instant alerts in case of suspicious activities. This means that if something unusual happens with your account, you’ll be notified immediately to act quickly. - Identity Theft Protection:

The Active Cash includes monitoring and recovery services for identity theft cases. If you face an issue, you can count on Wells Fargo’s support to help resolve the situation. - Digital Wallet Integration:

Forget the need to carry a physical card everywhere. The Active Cash is compatible with Apple Pay, Google Pay, and Samsung Pay, allowing you to make secure and convenient payments directly from your phone.

These features make using the Active Cash much safer, whether for online purchases, everyday use, or even international travel. Security and convenience go hand in hand with this card!

The Wells Fargo Active Cash is an excellent card for those who want to earn cash back without hassle.

With 2% cashback on all purchases, no annual fee, and an enticing initial offer, it stands out in the market. If you make frequent purchases and want to make the most of every cent spent, it’s well worth considering.

Now it’s up to you! Analyze your needs, see if it fits your lifestyle, and if it makes sense, apply for it and start earning rewards. After all, who doesn’t like to see money coming back to their pocket?