The Truth About the Citi Strata Elite: Perks That Actually Matter

Thinking about upgrading your credit card? The name everyone’s talking about right now is the Citi Strata Elite. But let’s be real—does this card actually live up to the hype?

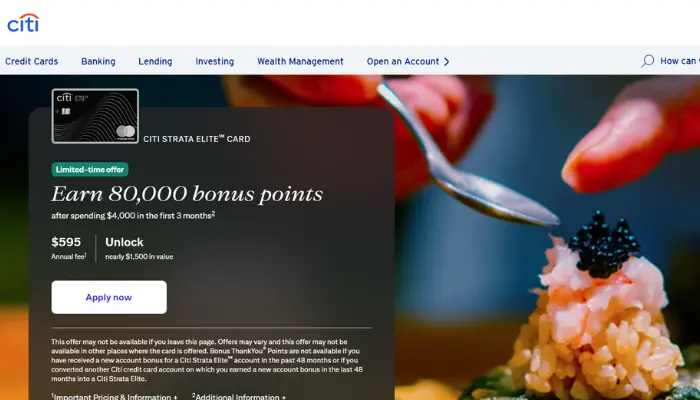

Advertisement

It sounds fancy, promises a lot of perks, but is it really worth it? If you’re curious and want the full scoop without the fluff, you’re in the right place. Let’s break it all down in plain English.

Advertisement

How to Apply for the Citi Strata Elite

So, you’ve read the perks and think the Citi Strata Elite might be your next card? Good call. Applying is actually super simple and doesn’t take more than a few minutes. But before jumping in, let’s walk through the steps to make sure you do it right—and increase your chances of getting approved.

Step-by-Step Guide:

- Go to the official Citi website

Head over to: citi.com/credit-cards/citi-strata-elite - Click “Apply Now”

The big button is easy to spot. Hit it to start your application. - Fill in your details

You’ll need to enter your:- Full name

- Address

- Social Security Number (SSN)

- Annual income

- Employment status

- Monthly housing cost

- Double-check everything

Before hitting “submit,” make sure there are no typos—especially in your income or SSN. - Submit your application

Once it’s all filled out, send it in. Most people get a decision within minutes, but sometimes Citi might need a little more time or extra documents.

If you’re approved, you’ll usually get your card in the mail within 7–10 business days. If not, Citi may follow up asking for more info—or suggest a different card.

Advertisement

Thinking ahead and applying smart increases your odds and helps you avoid unnecessary credit checks. So take a minute, prep yourself, and go for it when you’re ready.

What Is the Citi Strata Elite?

The Citi Strata Elite is one of those premium-level cards that gives off serious “VIP” energy. It’s Citi’s top-tier offering, designed for people who want premium benefits—especially if you travel a lot, spend money on entertainment, or just love rewards.

Now, don’t think it’s only for rich folks. Plenty of regular, hardworking people can benefit from this card too—especially if they manage their money well. The basic idea is simple: the more you spend, the more rewards you rack up. But the real value comes from using the card smartly.

Benefits of the Citi Strata Elite: What’s in It for You?

Alright, let’s get into the good stuff—because the Citi Strata Elite doesn’t hold back when it comes to perks. If you’re gonna pay for a premium credit card, it better come loaded, right? And this one definitely does. Whether you travel a lot, love a good concert, or just want peace of mind when you buy something expensive, this card has something for you.

Here’s what you can expect:

- Priority Pass Airport Lounge Access

No more sitting by the gate fighting for an outlet. With this card, you get access to over 1,300 lounges worldwide—comfy seats, free snacks, Wi-Fi, and a much better travel experience. - Annual Travel Credits

The card gives you travel credits every year to help balance out the annual fee. It’s like getting cashback on the stuff you were going to spend on anyway. - Travel Insurance & Rental Car Coverage

Missed flight? Lost luggage? Rental car accident? You’re covered. These protections kick in when plans don’t go as expected. - Citi Entertainment Access

Be the first to grab tickets to concerts, live shows, and special events. Citi gives cardholders early access and sometimes even VIP experiences. - Purchase Protection

Bought something and it got stolen, damaged, or just didn’t go as planned? This card can have your back with coverage for a limited time after the purchase. - 24/7 Concierge Service

Need help booking a last-minute trip? Want a dinner reservation at a fully booked restaurant? The concierge is your personal assistant, available anytime.

And that’s just the beginning. The Citi Strata Elite was clearly built to compete with other luxury cards on the market like the Amex Platinum and Chase Sapphire Reserve—but with a slightly lower annual fee and a more flexible rewards setup.

Bottom line? If you’re the type of person who actually uses your credit card benefits, this one can seriously pay off.

How the Citi Strata Elite Rewards Program Works

If you’re gonna use a credit card, you might as well get something back for it, right? That’s where the Citi Strata Elite really shines. This card doesn’t just let you swipe and go—it turns your everyday spending into real rewards you can actually use.

Whether you’re eating out, booking a flight, or grabbing concert tickets, you’ll rack up points fast. And the best part? The rewards aren’t just fluff—you can turn them into travel, gift cards, or even cash (if that’s more your style).

Here’s how it works:

- 3 points per dollar spent at restaurants, live entertainment, hotels, and airlines

- 1 point per dollar on everything else

All your points go into Citi’s ThankYou® Rewards program, where you can redeem them for:

- Flights and travel

- Cashback (not the best value, but it’s there if you want it)

- Gift cards, electronics, and more

- Transfers to airline and hotel loyalty programs

And don’t worry about rushing to use them—your points don’t expire as long as your account stays open and in good standing.

If you use this card the right way, you’ll be stacking up points without even trying.

How Much Is the Citi Strata Elite Annual Fee?

Let’s talk numbers—because no premium card comes free. The Citi Strata Elite charges a $495 annual fee.

Yeah, at first glance, that might feel like a punch to the wallet. But before you write it off, think sobre what you’re actually getting in return. If you travel even just a couple of times a year, that fee can pay for itself through:

- Airport lounge access (which can easily cost $40+ per visit if paid separately)

- Annual travel credits that reduce your real out-of-pocket cost

- Travel protections that could save you hundreds if plans go sideways

- Exclusive event perks and purchase protection

And here’s the kicker—it’s still cheaper than some of the other “big-name” premium cards out there. For example, the Amex Platinum runs you $695 a year. So if you’re looking for premium perks without the highest price tag, Citi Strata Elite hits a nice middle ground.

it’s not about the fee itself—it’s about what you get back. And if you actually use the benefits, that $495 starts to feel like a pretty smart investment.

Who Can Apply for the Citi Strata Elite?

Think this card is only for the rich and famous? Not even close. You don’t need to be a millionaire to apply for the Citi Strata Elite—but you do need to have your financial life em ordem.

This is a premium card, so Citi wants to see that you’re responsible with credit and have the income to back it up. If you’ve got solid credit and a steady paycheck, you’ve already cleared the first big hurdles.

Here’s what typically helps your chances:

- Credit score of 720 or higher – You don’t need a perfect score, but “good to excellent” puts you in a much better position.

- Annual income of around $75,000 or more – Citi doesn’t officially list a minimum, but that’s a solid ballpark to aim for.

- Clean credit history – No recent late payments, collections, or defaults.

- Some credit card experience – It helps if you’ve had other cards before and managed them well.

The application process is all online and usually takes less than 10 minutes. In many cases, you’ll get an instant decision. If Citi needs more info, they might ask for income verification or other documents—but that’s normal for premium cards.

Is It Good for Travel?

If travel is even a small part of your lifestyle—whether it’s for vacations, work trips, or just visiting family—the Citi Strata Elite can be a serious upgrade. This card wasn’t made for people who stay close to home. It was built with travelers in mind, offering a bunch of features that make flying smoother, safer, and a lot more comfortable.

You won’t be paying extra on international purchases, you’ll have a quiet place to relax in the airport, and you’ll earn more points just by booking the trips you were already planning. Plus, if something goes wrong—like a delayed bag or a canceled flight—the card has your back.

Here’s a quick look at what you get:

- No foreign transaction fees

- Access to 1,300+ airport lounges worldwide

- Travel insurance for cancellations, delays, and emergencies

- Bonus points on flights and hotels

- 24/7 concierge to help plan and book everything

In short? If you hit the road (or sky) even a few times a year, this card gives you way more value than a basic travel card ever could.

Downsides of the Citi Strata Elite

Let’s be real—no credit card is perfect. And while the Citi Strata Elite comes with a bunch of nice perks, it’s not the right fit for everyone. If you’re thinking em aplicar, é bom saber também o outro lado da moeda.

Here are a few reasons why this card might not be the best choice for you:

- The annual fee is steep—if you’re not using the perks.

$495 a year isn’t pocket change. If you’re not traveling, using the lounges, or cashing in on the benefits, that fee can feel like a waste. - You need to spend to really earn.

The rewards system is solid, but it’s built for people who swipe their card often—especially on travel, dining, and entertainment. If most of your purchases are small or just on bills, you won’t rack up points fast. - Cash redemptions aren’t that exciting.

You can redeem points for cashback, sure—but the value is lower compared to using them for travel. So if you’re not into redeeming for flights or hotels, you’re leaving value on the table. - Missing those “super premium” touches.

Unlike some of the higher-end cards, this one doesn’t automatically give you elite hotel status or luxury upgrades. It’s premium, but not ultra-luxury.

So if you’re the kind of person who likes to keep things simple, doesn’t travel much, or prefers no annual fees, a basic rewards card might make more sense for your lifestyle. No shame in that—what matters is choosing a card that fits how you actually spend and live.

Is the Citi Strata Elite Worth It in 2025?

So, after everything you’ve read so far, here’s the big question: is the Citi Strata Elite actually worth it in 2025?

The answer really depends on your lifestyle. This card isn’t made for everyone—it’s designed for people who will actually use the benefits often. If you’re just looking for a basic card to pay bills or make everyday purchases, there are likely better (and cheaper) options out there.

But if you love to travel, enjoy a more VIP experience, and want to turn your spending into real rewards, the Citi Strata Elite can offer solid value—even with the $495 annual fee.

Here’s the breakdown:

The card is worth it if:

- You travel at least twice a year (domestic or international)

- You want lounge access and travel protection without paying extra

- You spend regularly on restaurants, entertainment, and flights

- You enjoy earning points and redeeming them for travel or experiences

It might not be for you if:

- You rarely leave town or don’t travel by plane

- You’re on a tight budget or want to avoid annual fees altogether

- You don’t have the patience to deal with points and perks

- You prefer a simple, no-fuss credit card

The Citi Strata Elite is packed with value, but only if you take advantage of everything it offers. It’s not about flexing a premium card—it’s about making your money work for you.

Used the right way, this card can seriously level up your travel game and help you earn rewards fast. But don’t let the perks tempt you into overspending. Use it smart, pay it off each month, and enjoy the benefits like a boss.

Thinking about applying? Make sure it fits your lifestyle and spending habits. If it does, go for it—you’ll likely get way more out of it than you put in.