The Event Helper: Quick and Easy Event Insurance Guide

Organizing an event is a dream, but let’s be honest, it’s also quite a challenge, right? There’s always that little fear: “What if something goes wrong?”

Advertisement

That’s where The Event Helper comes in, a service specialized in event insurance. Whether it’s a wedding, a fair, or even a show, this platform promises to save you from major headaches. Ready to understand everything about it?

Advertisement

What Is The Event Helper?

The Event Helper is a company that offers specific insurance for events. Imagine you’re planning that amazing party, and an unexpected situation arises, like an accident or damage to the event venue.

This insurance gives you the financial protection to handle these situations without panic.

Advertisement

The company operates as a super easy-to-use online platform. You visit the website, choose the type of event, adjust the details, and voilà, you’re ready to purchase the coverage you need. It’s like getting car or home insurance, but tailored for events.

Why Get Event Insurance?

If you think insurance is only for people with a lot of money or giant events, forget that idea. Event insurance is not just a “luxury”; it’s a necessity.

When you organize any event, whether it’s a birthday party or the wedding of your dreams, there’s always a risk that something might go wrong. And let’s face it, who wants to deal with stress when the goal is to celebrate or impress?

Having insurance is like having a Plan B that financially protects you and gives you peace of mind. After all, organizing an event takes time, investment, and often some hard-earned savings.

Insurance helps ensure all that effort doesn’t go to waste if something unexpected happens.

Here are the main reasons to consider this protection:

- Prevention of losses: Accidents can happen, and no one wants to bear the costs alone.

- Peace of mind: You can focus on enjoying or managing the event without constantly worrying about “what if.”

- Requirement: Many venues and suppliers require you to have insurance to finalize contracts.

Plus, it adds a lot of credibility, right? It shows you care about safety and your guests.

Who Can Use The Event Helper Services?

The Event Helper is a universal solution, perfect for anyone or any company organizing an event, whether it’s an intimate dinner or a massive party.

No matter the size or occasion, if you want to ensure safety and avoid headaches, this platform is for you. Here’s who can benefit:

- Couples: Planning a wedding? This insurance covers everything from venue issues to damages caused by overly enthusiastic guests.

- Businesses: Corporate events can also benefit from this protection.

- Show Producers: Imagine an international band canceling last minute. Without insurance, the financial loss could be enormous!

- Fair Organizers: To ensure everything runs smoothly without hiccups.

- Everyday People: Throwing a 15th birthday party or a baby shower? You can also get coverage.

No matter the event size, The Event Helper has options for everyone.

What Coverages Are Offered?

The event insurance offered by The Event Helper is super comprehensive, designed to cover those unexpected situations no one wants to face but might happen anyway.

No matter the type of event you’re organizing, the goal is to protect you and minimize potential losses. Here are the main coverages:

- Liability Insurance: If someone gets hurt at the event or causes damage to third parties, the insurance covers legal and medical costs.

- Venue Damage: Broke something at the venue or caused some damage? It’s covered.

- Cancellations: Events postponed or canceled due to circumstances beyond your control.

- Bodily Injuries: Guests or staff got injured? The insurance has your back.

- Theft or Vandalism: If any equipment gets stolen or damaged, you can also file a claim.

Each event is unique, so you can adjust the coverage according to your needs.

How to Apply for Insurance on The Event Helper?

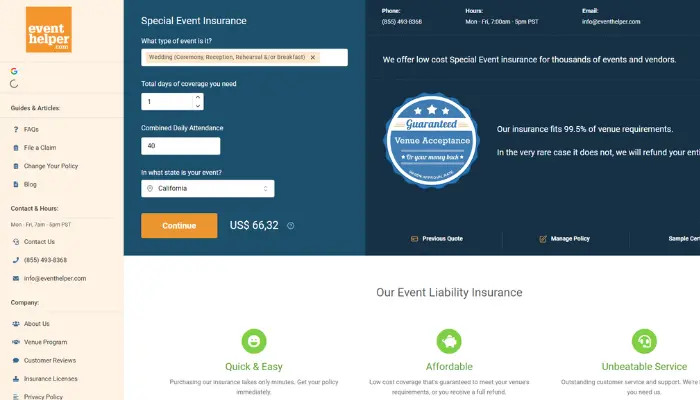

Getting insurance on The Event Helper is so simple it feels like a breeze. The platform was designed to be quick and intuitive, no hassle.

If you’ve ever ordered food through an app or bought something online, you’ll find this process a piece of cake. Here’s the step-by-step guide:

- Visit The Event Helper Website: Go to the official site. The page is well-organized and user-friendly, even for those not tech-savvy.

- Select the Type of Event: You’ll find various options like weddings, shows, fairs, and more. Just choose the category that best fits your event.

- Fill in the Details: Now it’s time to provide the basics—event date, location, number of guests, and other important information. Don’t worry; the process is quick and straightforward.

- Choose Your Coverage: Here, you decide exactly what to protect, like liability insurance, venue damage, cancellations, and more. Everything can be customized to suit your needs.

- Make the Payment: Once you’ve tailored the coverage, complete the process with an online payment. They accept credit cards, and the system is secure and easy to use.

- Receive Your Policy: As soon as the payment is confirmed, you’ll receive the policy via email. This document guarantees your protection and outlines all the covered aspects.

And that’s it! Now you can focus on organizing your event with the peace of mind that, if anything goes wrong, you’re protected. Easy, right?

How Much Does Event Insurance Cost?

Here comes the question everyone asks: how much does event insurance cost? And the answer is… it depends! But don’t worry, it’s not as complicated as it sounds.

The cost of insurance can vary based on several important factors, such as the type and size of the event. Let’s break it down for you:

- Event Size: The number of guests makes a difference. The more people, the higher the risk, which affects the insurance price.

- Location: The venue also plays a role. Outdoor events or large spaces may cost more to insure than a small indoor venue.

- Selected Coverages: You can customize your insurance with the coverages you find most important. The more items you protect, the higher the cost.

- Event Duration: Longer events, like weekend parties or multi-day fairs, usually cost more than single-day events.

For a practical idea: insurance for small events, like birthday parties or intimate gatherings, can start around $50.

Larger events, such as weddings, concerts, or big fairs, can exceed $500, depending on the coverages and specific conditions.

Is it worth it? Absolutely! When you compare the cost of insurance with the potential losses if something goes wrong, you realize it’s a smart investment.

After all, no one wants to spend even more fixing problems during an event that should be a success!

Frequently Asked Questions About Event Insurance

When it comes to event insurance, it’s normal to have a lot of questions. After all, no one wants to invest in something without knowing exactly how it works, right?

Here are the answers to the most common questions about the insurance offered by The Event Helper:

- What should I do in case of a claim? Contact The Event Helper, submit the necessary documents, and follow their instructions.

- Can all events be insured? No. Events involving extreme sports, high risks, or illegal activities are not covered.

- Can I cancel the insurance? Yes, but it’s important to check the refund policies.

- Does the insurance cover delays? Generally, no, but you can negotiate this directly with the provider.

If you want to ensure your event goes smoothly without stress, The Event Helper is a smart choice.

With affordable prices, comprehensive coverages, and a simple application process, this platform is perfect for those who don’t want to take risks. After all, unexpected things happen, but it’s always better to be prepared.

No matter if you’re organizing a wedding, a concert, or a fair, insurance gives you the peace of mind that everyone deserves. So, let go of the stress and focus on what truly matters: making your event a success!