How Progressive Event Insurance Protects Your Big Day

Organizing an event is exciting, but it can also be stressful. With so many details to handle, nobody wants to deal with unexpected problems that can be costly.

Advertisement

This is where Progressive Event Insurance comes in—a policy that protects you from unforeseen issues and ensures your event runs smoothly, or at least minimizes your losses.

Advertisement

In this article, we’ll explain everything about this insurance in a simple and straightforward way, so you can fully understand the topic.

What Is Progressive Event Insurance?

Progressive Event Insurance is a type of insurance offered by Progressive Insurance, one of the largest insurance companies in the United States.

Advertisement

It is designed to protect events of various sizes and styles against potential problems. Whether it’s a wedding, a concert, or even a corporate event, this insurance ensures that you don’t have to bear unexpected losses on your own.

Have you ever thought about what you would do if your event venue canceled at the last minute? Or if someone got injured during the event and you were held responsible?

Progressive Event Insurance covers situations like these, providing a safety net that makes everything more manageable.

Why Should You Get Progressive Event Insurance?

If you think event insurance is a luxury, think again. Any event, even the simplest ones, involves risks.

Someone might damage an expensive piece of equipment, the event could be canceled due to bad weather, or a guest might get injured. Without insurance, all these problems could come out of your pocket.

Additionally, many venues and vendors require you to have insurance before signing a contract with them. This means that getting Progressive Event Insurance is not just an extra layer of protection but, in some cases, a necessity to hold the event.

Types of Events Covered

One of the biggest advantages of Progressive Event Insurance is its ability to adapt to different types of events.

It offers protection for a wide range of occasions, ensuring you are covered no matter the size or style of your celebration.

Here are some examples:

- Weddings: Protect the most special day of your life against unexpected issues.

- Festivals and Concerts: Ideal for outdoor events with large crowds and complex setups.

- Corporate Events: Meetings, conferences, and business training sessions.

- Private Parties: Birthdays, graduations, baby showers, and more.

- Sports Events: Coverage for competitions, amateur games, or professional matches.

With this flexibility, Progressive Event Insurance adapts perfectly to your needs, regardless of the type of event you plan to host.

Coverage Offered by Progressive Event Insurance

Now it’s time to talk about what really matters: the protections offered by Progressive Event Insurance. After all, the primary function of insurance is to cover unforeseen events and provide peace of mind.

With comprehensive and flexible options, this insurance ensures you are prepared to handle various scenarios, from minor incidents to major setbacks. Here are the key coverages that can save your event:

- Event Cancellation or PostponementIf your event is canceled or postponed due to reasons like natural disasters, health issues of key individuals, or other unforeseen circumstances, you will be reimbursed for the costs already incurred.

- General LiabilityThis coverage protects against third-party claims. For example, if someone gets injured at your event or you accidentally cause damage to the venue, the insurance covers the expenses.

- Property CoverageRented equipment such as sound systems, lighting, or even expensive decorations can be protected in case of damage or theft.

- Liquor LiabilityIf your event includes alcohol, this coverage helps protect you against incidents such as accidents caused by intoxicated guests.

- Extras and CustomizationsYou can add specific coverages tailored to the unique needs of your event.

With these options, Progressive Event Insurance covers all the bases, allowing you to focus solely on the success of your event!

What Is Not Covered?

While Progressive Event Insurance offers a wide range of protections, it’s essential to understand the situations that are not included in the coverage.

This helps avoid unpleasant surprises when filing a claim. Here are the main exclusions:

- Forecasted weather conditions (if you knew it would rain, there’s no reimbursement).

- Cancellations due to changes of heart (such as deciding not to get married).

- Intentional damage caused by guests or organizers.

- Illegal activities or events that do not comply with the law.

Before purchasing, it’s crucial to review the contract and clarify any doubts with the insurer. This ensures the coverage meets your specific needs and prevents future frustrations!

How Much Does Progressive Event Insurance Cost?

One of the first questions when considering insurance is: “How much will this cost me?” The good news is that Progressive Event Insurance has flexible and affordable pricing, tailored to the specific needs of each event.

The policy cost depends on several factors, meaning you can find coverage that fits your budget.

Key Factors That Influence the Cost

- Type of Event: Weddings, concerts, and private parties have different risks and requirements, which affect the final price.

- Number of Guests: The more people at the event, the higher the risk and, consequently, the cost.

- Location: The event venue can influence the price, especially if it’s in a high-risk area or requires specific coverages.

- Inclusion of Alcohol: Events that serve alcohol typically have additional costs due to the increased associated risks.

- Value of Goods and Equipment: If you’re renting or using expensive items like sound systems, lighting, or decorations, the total value of the covered assets can impact the price.

Estimated Price Range

- Small events: Costs start at around $100, usually sufficient for intimate gatherings or events with few guests.

- Large events: Costs can range from a few hundred to thousands of dollars, depending on the complexity and level of coverage required.

Is It Worth the Investment?

While it may seem like an additional expense in your planning, insurance is an essential protection. Imagine the cost of dealing with a canceled event, damaged rented equipment, or a lawsuit because of an accident.

Compared to potential losses, the benefits of insurance easily outweigh the investment.

If you’re organizing an event, don’t underestimate the importance of insurance. It’s more than just an expense—it’s peace of mind that’s worth every penny!

How to Purchase Progressive Event Insurance?

Getting Progressive Event Insurance is a simple and straightforward process. With just a few steps, you can secure the protection needed for your event and avoid unnecessary stress. Here’s a practical guide to help you:

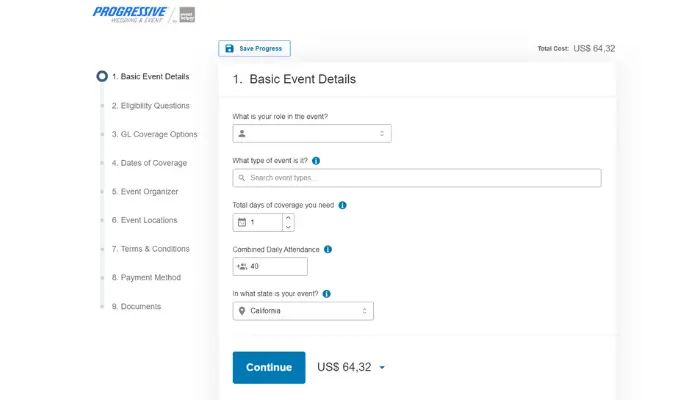

- Visit the Progressive WebsiteGo to the official website and look for the section on event insurance.

- Fill Out the Quote FormProvide basic information about your event, such as the date, location, number of guests, and type of event.

- Select Your CoverageChoose the protections that best suit your event’s needs.

- Review and FinalizeCheck the policy details, confirm the pricing, and complete the payment.

- Receive Your PolicyOnce completed, you’ll receive your policy via email. Keep this document safe!

By following these steps, you’ll be ready to organize your event with the peace of mind that only reliable insurance can provide!

How to File a Claim with Progressive Event Insurance?

Unforeseen incidents can happen, and when they do, your insurance is there to ensure you’re not left dealing with the consequences alone. Filing a claim with Progressive Event Insurance is straightforward and hassle-free.

Here’s a guide to help you through the process:

- Contact ProgressiveUse the phone or website to initiate your claim.

- Provide DetailsExplain what happened, including dates, photos, witnesses, and receipts, if available.

- Follow UpProgressive will review your case and reach out to you for further steps.

- Receive CompensationOnce approved, payment will be made within the timeframe specified in the contract.

Tips for Organizing a Safe Event

Even with Progressive Event Insurance, prevention is always the best approach. A well-planned and secure event reduces the likelihood of issues and ensures everything goes smoothly.

Here are some practical tips to help you organize a safe and worry-free event:

- Choose a reliable venue and inspect it beforehand.

- Have a team ready to handle emergencies.

- Inform guests about basic safety rules.

- Work with reputable vendors.

- Ensure all equipment is in good working condition.

Do I Need to Purchase in Advance?

Yes, purchasing Progressive Event Insurance in advance is always the best choice. Some specific coverages, such as cancellation due to unforeseen circumstances, may require a minimum lead time to be valid.

Additionally, the sooner you purchase, the more time you’ll have to adjust the policy to meet your event’s needs.

Does It Cover Outdoor Events?

Yes, the insurance covers outdoor events. However, it’s important to note that forecasted weather conditions, such as rain announced in advance, are typically not included in the coverage.

For outdoor events, it’s worth discussing potential adjustments to the policy with the insurer.

Is Insurance Mandatory?

It depends. In many cases, venues and vendors require insurance to finalize contracts.

This is a common practice for larger events or at venues that want to ensure protection against risks. Even when it’s not mandatory, having insurance is a smart step to avoid unexpected financial setbacks.

Progressive Event Insurance is the ideal solution to protect your event from unforeseen issues that could be costly.

With flexible coverages, affordable pricing, and the trusted reputation of Progressive, you can plan your party, wedding, or conference with confidence. Don’t wait until the last minute—protecting your event means protecting your wallet and your peace of mind!