How to Apply for the US Bank Shield

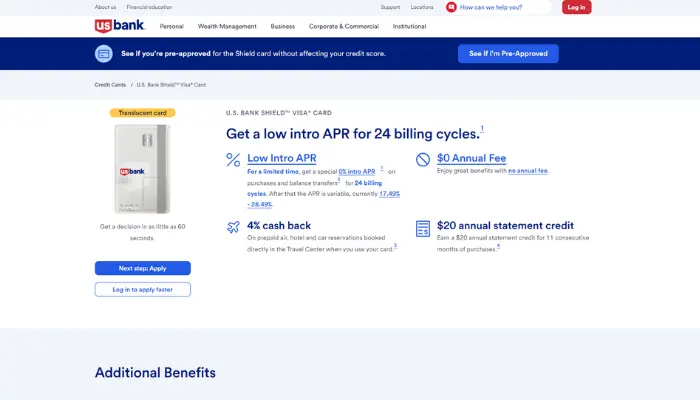

Have you heard about the U.S. Bank Shield™ Visa® Card? It’s been getting attention for offering a 0% intro APR period on both purchases and balance transfers for a long stretch — which can give you some breathing room or help you pay off higher-interest credit card debt.

Advertisement

But applying for this card isn’t just about hitting “Apply Now” and hoping for the best. There are smart ways to do it — ways that improve your approval odds, help you understand the fine print, and make sure you actually benefit from it instead of getting caught by surprise later.

Advertisement

In this guide, you’ll learn exactly how to apply for the U.S. Bank Shield Card, what you’ll need, who qualifies, and what to expect once you apply — all explained in simple, everyday English.

What Is the U.S. Bank Shield Card?

If you’ve been searching for a credit card that gives you some real breathing room, the U.S. Bank Shield Visa Card might catch your eye.

Advertisement

It’s designed for people who want flexibility — especially if you’re trying to pay off debt without piling on more interest or you just need time to handle big purchases comfortably.

In simple terms, this card focuses on low costs and long relief instead of fancy travel rewards or complicated points programs. It’s perfect for someone who’d rather keep things simple and save money over the long run.

Key Features and Benefits

Here’s what makes the U.S. Bank Shield Card stand out:

- 0% intro APR on both purchases and balance transfers for 24 billing cycles when you apply directly through U.S. Bank.

- After that, the rate becomes variable — from 17.74% to 28.74% APR, depending on your credit.

- No annual fee — you don’t pay anything just to keep the card open.

- 4% cash back on prepaid travel bookings (flights, hotels, car rentals) made through the U.S. Bank Rewards Center.

- Cell phone protection — up to $600 in coverage when you pay your phone bill with this card.

- Extra perks: rental-car insurance, extended warranty, and purchase protection.

- Balance-transfer fee: 5% of the amount transferred (minimum $5) for transfers made within the first 60 days.

Things to Watch Out For

Like any credit card, the Shield Card isn’t perfect. Before applying, keep these details in mind:

- Once the intro period ends, the variable APR can jump high depending on your credit and market rates.

- Rewards are limited — the 4% rate only applies to prepaid travel through U.S. Bank’s portal.

- The 5% transfer fee may offset some of the savings you expect.

- Every application triggers a hard credit check, which can temporarily lower your credit score.

- Good credit history is usually required for approval.

- To get the 0% on transferred balances, you must complete the transfer within 60 days of account opening.

In short, it’s a smart card if your goal is to save money on interest for a year or two — not so much if you’re after big cash-back rewards or plan to spend abroad often.

Who Can Apply? Eligibility Requirements

Before hitting that “Apply Now” button, it’s smart to make sure you actually qualify for the U.S. Bank Shield Visa Card. Like most credit cards with a long 0% intro APR offer, this one isn’t meant for people who are just starting to build credit — it’s designed for those who already have a decent financial track record.

Here’s what U.S. Bank usually looks for when reviewing applications:

1. Age Requirement

You must be at least 18 years old to apply. That’s the legal minimum for credit card applications in the U.S.

2. Citizenship or Residency

You’ll need to be a U.S. citizen or legal resident, with a valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). This helps the bank verify your identity and credit history.

3. Credit Score

U.S. Bank typically wants applicants with good to excellent credit, which usually means a FICO score of 670 or higher. If your score is below that, you might still get approved, but your credit limit or terms may be less favorable — or you could be declined altogether.

4. Stable Income

You’ll need to show steady income that proves you can pay your monthly balance. This doesn’t have to come from just one job — it can include multiple sources, like wages, self-employment, or benefits, as long as you can document it.

5. Clean Credit History

Try to avoid applying if you’ve had recent bankruptcies, charge-offs, or late payments. Lenders like to see responsible credit use — on-time payments and reasonable use of available credit are big positives.

6. U.S. Residential Address

You must have a U.S. residential address (not just a P.O. box) so the bank can verify where you live and send your physical card.

7. Credit Check Authorization

When you apply, U.S. Bank will perform a hard credit inquiry — this is a standard part of the process. It can cause a small, temporary drop in your score (usually just a few points), but it’s necessary to assess your eligibility.

What If You Don’t Meet These Requirements Yet?

Don’t stress — everyone starts somewhere. If you’re not quite there yet, here are a few easy ways to boost your chances before applying:

- Pay your bills on time — even one missed payment can hurt your score.

- Lower your credit utilization — try to keep your balances under 30% of your total limit.

- Keep older accounts open — long-standing accounts help build a stronger credit history.

- Avoid applying for too many cards at once — each application adds another hard inquiry.

- Consider a secured card first to build or rebuild your credit before applying for something like the Shield Visa.

- With a little preparation and consistency, you can easily reach the credit level U.S. Bank looks for — and once you do, applying for the Shield Card will feel like a natural next step.

How to Apply for the U.S. Bank Shield Card — Step by Step

Applying for the U.S. Bank Shield Visa Card is simple, but taking a few extra minutes to understand the process can save you from mistakes that might slow things down or even get your application denied.

Whether you prefer doing things online, over the phone, or in person, U.S. Bank gives you flexible ways to apply — and the entire process can be completed in just a few minutes if you have your information ready.

This step-by-step guide will walk you through everything you need to know: where to apply, what documents to have on hand, and what to expect once you hit “Submit.” It’s all about making your application as smooth (and successful) as possible.

3.1 Ways to Apply

You can apply in three different ways:

- Online — the fastest and most common method.

- By phone — calling U.S. Bank’s credit-card service line.

- In person — at a U.S. Bank branch (if you live near one).

3.2 Applying Online — Step by Step

- Go to the official U.S. Bank website and select the Shield Visa Card page.

- Click “Apply Now” or “Learn More / Apply.”

- Read the terms and conditions carefully — especially the interest details and fees.

- Fill in your personal information: full name, date of birth, address, phone, email.

- Enter your SSN (Social Security Number) or ITIN.

- Provide financial details: annual income, employment status, and housing information.

- Authorize the credit check (a standard hard inquiry).

- Review everything carefully — even a small mistake can cause delays or denial.

- Submit your application.

After submission:

- Some people get an instant decision, others may wait a few days for manual review.

- If approved, you’ll receive the physical card in the mail within 3–7 business days.

- If denied, you can request a reconsideration call to have your application reviewed again.

3.3 Applying by Phone or In Person

- By phone: Call the U.S. Bank credit-card application line (typically 800-717-6166) and ask to apply for the Shield Visa.

- In person: Visit a U.S. Bank branch and bring valid ID, proof of income, and proof of address. A bank representative can help you apply on the spot.

What Happens After You Apply

So you’ve submitted your application — now what? This part can feel like the waiting game, but knowing what comes next makes the whole process less stressful.

Once U.S. Bank receives your information, they’ll review your credit, income, and other details to decide whether to approve your application.

If everything checks out, approval can happen in just a few minutes — sometimes instantly. In other cases, it might take a few business days if the bank needs to verify more information.

From there, it’s all about tracking your application, activating your card once it arrives, and making sure you take full advantage of that 0% intro APR period right from the start.

This section breaks down what to expect after you apply and how to handle each step, whether you’re approved right away or need to try again later.

- You can check your application status by calling U.S. Bank’s support line (around 800-947-1444).

- When approved, watch for the card to arrive by mail and activate it immediately.

- If you plan to transfer a balance, do it within the first 60 days to qualify for the 0% rate.

- During the intro period, focus on paying off existing debt or large purchases without adding new ones.

- Once the intro APR ends, be ready for the regular rate to kick in.

If your application is denied, you can call for a reconsideration or wait a few months, improve your credit, and try again.

Tips to Increase Your Chances of Approval

Getting approved for a credit card isn’t just about luck — it’s about preparation. The U.S. Bank Shield Visa Card is designed for people with solid credit, but even if you’re not perfect, there are smart moves you can make to improve your odds before applying.

Think of it like warming up before a game — a few small actions can make a big difference once you hit “Apply.” From tightening up your credit usage to checking your information for simple mistakes, these steps can help you look like the kind of borrower banks love to approve.

Below are practical ways to strengthen your application and boost your chances of hearing that sweet word: “Approved.”

- Keep credit use low: Pay down balances on your other cards.

- Pay bills on time: Late payments hurt your score fast.

- Avoid opening too many new accounts in a short period.

- Double-check your info: Make sure your address, income, and employment details are accurate.

- Look for a pre-approval tool: U.S. Bank sometimes offers a soft-pull check so you can see if you’re likely to qualify without hurting your score.

- Don’t freeze your credit reports before applying — the bank needs access to review your credit.

These small steps make a big difference when the bank’s system decides who gets approved.

Is It Worth Applying? Things to Consider

Before you apply, it’s smart to ask if the U.S. Bank Shield Visa Card really matches your goals. This card focuses on helping you save on interest — not on earning big rewards or travel perks.

It’s a great tool if you want time to pay off debt or make a big purchase without interest. But if you’re chasing cashback or plan to use it abroad, there might be better options out there.

Let’s break down the pros and cons so you can see if it’s the right fit for you.

Pros

- Long intro period with 0% APR on purchases and balance transfers (up to 24 billing cycles).

- No annual fee.

- 4% cash back on U.S. Bank travel bookings.

- Cell phone and purchase protection benefits.

- Great option for consolidating high-interest credit card debt.

Cons

- Regular APR can be high after the intro period.

- Rewards are limited and only through the U.S. Bank travel portal.

- 5% balance transfer fee can reduce savings.

- Requires good credit to qualify.

- Foreign transaction fees apply (about 3%).

If your goal is to get out of debt or finance a big purchase without interest for a couple of years, the Shield Card is a strong choice.

But if you want a card with bigger rewards for everyday spending or international use, other options might fit you better.

Comparing It to Similar Cards

The U.S. Bank Shield Card isn’t the only credit card offering a long 0% intro APR, so it’s worth seeing how it stacks up against similar options. Some cards give shorter no-interest periods but stronger rewards, while others focus purely on balance transfers.

If your goal is to get the longest break from interest, the Shield Card easily competes with some of the best offers out there. But if you’re after everyday rewards or travel perks, you might find more value in other alternatives.

- Some Shield offers give 18 months of 0% APR, while the direct U.S. Bank offer gives 24 billing cycles.

- Wells Fargo Reflect offers around 21 months of 0% APR on purchases and transfers.

- Citi Simplicity and BankAmericard also have long intro periods, though usually shorter than Shield’s.

If you mainly want a card to spread payments without interest, Shield is a solid option. If you care more about cash back or travel perks, look at alternatives like Citi Custom Cash or Chase Freedom Unlimited.

The U.S. Bank Shield Visa Card is a great option for people looking to catch up financially, consolidate debt, or make a large purchase without paying interest for a long time.

It’s not a rewards powerhouse, but that’s not its goal — its strength is simplicity: a long 0% APR period, no annual fee, and a few handy protections.

Just remember: once that intro period ends, interest kicks in — so use the time wisely to pay off your balances.

For those with good credit and a plan to manage it smartly, the U.S. Bank Shield Card can be a very useful tool.