How to Apply for the Amex Blue Cash Preferred Card

If you’re tired of credit cards that give you almost nothing back for your everyday spending, it’s time to meet the Amex Blue Cash Preferred Card — one of the most popular cashback cards from American Express.

Advertisement

But before you jump in, let’s slow down a bit. Applying for a credit card isn’t just filling out a form — it’s about knowing if you qualify, understanding the benefits, and making sure it actually fits your lifestyle.

Advertisement

In this guide, I’ll explain everything you need to know before applying — from the requirements to the application steps, approval tips, and how to get the most out of it once you’re approved.

What Is the Amex Blue Cash Preferred Card?

The Amex Blue Cash Preferred is a cashback credit card made for people who spend a lot on groceries, streaming, gas, and transportation. Unlike those “fancy travel cards” that only make sense for jet-setters, this one rewards your real life — your Netflix, your grocery runs, your gas refills.

Advertisement

Here’s the cool part:

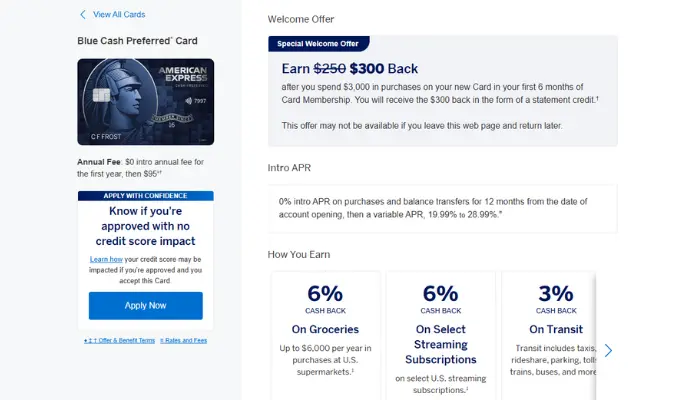

- 6% cashback at U.S. supermarkets (up to $6,000 per year, then 1%)

- 6% cashback on select streaming services (like Netflix, Hulu, Disney+, etc.)

- 3% cashback on U.S. gas stations and transit (taxis, rideshares, parking, trains, etc.)

- 1% cashback on everything else

Plus, Amex usually gives a welcome bonus — for example, $250 statement credit after you spend $3,000 in the first six months.

The annual fee is around $95, but Amex often waives it for the first year. And yes, you get all the Amex perks: great customer service, fraud protection, and access to special offers.

It’s not just another plastic card — it’s a real money-saver if you play it smart.

Why It Might Not Be for Everyone

Let’s be honest — the Amex Blue Cash Preferred isn’t perfect.

If you barely shop at supermarkets or you mostly buy online from Amazon, you might not see big rewards. The 6% cashback only works at U.S. grocery stores, not at big online retailers.

Also, that $95 annual fee after the first year might bother you if you don’t use the card enough.

And like most Amex cards, you’ll need good to excellent credit to get approved — usually a credit score above 670.

But if you’re someone who buys groceries weekly, subscribes to streaming platforms, and drives regularly — this card can give you serious cashback every month.

Requirements Before You Apply

Before you click that big “Apply Now” button, let’s slow down and make sure you actually meet what American Express is looking for. The company doesn’t approve everyone — they want to see that you’re ready to handle credit responsibly and that this card is the right fit for you.

So before you waste a hard inquiry on your credit report, check these points carefully.

Age and Residency

You need to be at least 18 years old (or the legal age in your state) and live in the United States. American Express requires a valid U.S. address, and most of the time you’ll also need a Social Security Number (SSN).

If you’re not a U.S. citizen but live in the country legally, you might still qualify — but only if you have an Individual Taxpayer Identification Number (ITIN) and proper documentation. Basically, Amex needs to verify your identity and credit background inside the U.S. system.

Credit Score and History

Your credit score is one of the biggest factors. For the Amex Blue Cash Preferred, the sweet spot is a score of 670 or higher (Good to Excellent range).

But it’s not only about the number — Amex also looks at how you’ve been using your credit:

- Do you pay your bills on time?

- Do you keep your credit card balances low?

- Have you opened a bunch of new accounts recently?

If your score isn’t there yet, don’t worry. You can start with a no-annual-fee Amex card or even a secured card, use it responsibly for a few months, and then upgrade once your credit improves. It’s like training before the big game.

Income and Employment

When you fill out the application, Amex will ask about your annual income and where it comes from. You don’t need to make six figures — they just want to know that you can cover your monthly bills and that your credit use won’t put you at risk.

You can include income from:

- A full-time or part-time job

- Freelance or side hustles

- Government benefits

- Spouse or partner income (if it’s shared for household expenses)

Always be honest with your income. Amex may request proof if something looks off, and lying on credit applications can hurt your approval chances.

U.S. Bank Account and Identification

You’ll need to verify your identity and financial base. Make sure you have:

- Your Social Security Number (SSN) or ITIN

- A valid photo ID (like a driver’s license or state ID)

- Banking information, in case Amex needs to confirm deposits or verify your address

Having a U.S. checking account in your name helps too. It shows you’re financially active in the country and ready to handle credit responsibly.

Amex’s Internal Review

Here’s something most people don’t know: Amex uses its own internal scoring system, not just your credit bureau score.

If you already have another Amex card, your relationship history matters a lot. They’ll check:

- How long you’ve been a customer

- If you’ve made payments on time

- How much of your limit you usually use

- Whether you’ve had any late or missed payments

If your history with Amex is clean, your approval odds go way up. But if you’ve had issues before (like missed payments or too much debt), that could make it harder.

Amex also limits how many cards you can have at once, so if you already hold several, they might suggest an upgrade instead of a new approval.

How to Apply for the Amex Blue Cash Preferred Card (Step-by-Step)

Getting your Amex Blue Cash Preferred Card is way easier than most people think. You don’t need to visit a bank, wait in long lines, or deal with complicated paperwork — everything happens online in under 10 minutes.

But since this is a credit card that requires a solid financial profile, it’s worth doing things right from the start. Let’s walk through the whole process so you know exactly what to expect before, during, and after you hit that “Apply Now” button.

Step 1: Go to the Official American Express Website

Start by visiting the official American Express website.

Once you’re there, scroll until you find the Blue Cash Preferred Card page. Don’t get confused — Amex has several “Blue Cash” versions (like the “Blue Cash Everyday”), so double-check that you’re picking the Preferred one.

if you see a banner showing a welcome offer (like a $250 bonus), make sure that offer appears on your screen before you start the application — it’ll automatically attach to your account once approved.

Step 2: Click “Apply Now” and Fill Out the Form

When you click “Apply Now,” you’ll be taken to a short and simple application form. It usually asks for:

- Full name (as it appears on your ID)

- Date of birth

- Residential address (must be a valid U.S. address)

- Social Security Number (SSN) or ITIN

- Total annual income (include all sources)

- Employment status (employed, self-employed, student, etc.)

Be honest and consistent. Amex might use this info to verify your identity or match it with credit bureau data. If something doesn’t line up, it could delay your approval.

Step 3: Review All Information Before Submitting

Before you hit “Submit,” take a minute to double-check your details. Typos in your address or SSN could cause unnecessary verification steps later.

When you click submit, Amex might run a “soft pull” first — a light credit check that doesn’t impact your score — to show you if you’re pre-approved.

If you decide to continue and formally apply, that’s when they’ll perform a hard inquiry, which can temporarily lower your credit score by a few points. It’s normal and happens with any credit card application.

Step 4: Wait for a Decision (Usually Instant)

Here’s the good news: Amex is fast. Many applicants get an instant approval message right after submitting. You’ll see your new credit limit and can even start using a virtual card immediately through your Amex online account or app.

But if your application goes into “pending review,” don’t panic — it just means Amex needs a bit more time to verify your info. Sometimes they’ll contact you by email or phone within a few days for confirmation.

Common reasons for pending decisions:

- Income verification

- Recent credit inquiries

- Inconsistent personal details

- Internal review if you already have another Amex card

Step 5: Receive and Activate Your Card

Once approved, your physical card will arrive at your home in about 5 to 10 business days.

When it arrives:

- Go to the Amex website or open the American Express mobile app.

- Log in or create your account.

- Click “Activate Card” and follow the quick steps.

You can start using it right away for online purchases, even before the physical card arrives — Amex often gives immediate access to a digital card number.

Tips to Improve Your Chances of Approval

Getting approved isn’t just about luck — it’s about being ready. A few small moves before applying can make a big difference. The goal is to look responsible and low-risk in Amex’s eyes.

Here are some quick, real-life tips people use to boost their chances before hitting

- Pay down other credit cards first – Lower your credit utilization (below 30%).

- Avoid applying for multiple cards at once – Too many recent hard inquiries look risky.

- Check for pre-approval – Amex offers a “pre-qualification” tool that doesn’t hurt your score.

- Keep your income stable – Lenders like to see consistent income sources.

- Fix any late payments – Even one late bill can lower your approval odds.

- Use credit regularly and responsibly – Show that you can borrow and repay without issues.

If your credit score is close to 670 but not quite there, it might be worth waiting a couple of months to build it up. Patience can pay off.

What to Do If You Get Denied

Got a “no” from Amex? Don’t stress — it happens to a lot of people. A denial doesn’t mean you’ll never get approved; it just means there’s something to fix before trying again.

Here’s exactly what to do to turn that “no” into a future “yes.”

- Read the denial letter. Amex will tell you the reason — maybe your credit utilization is too high, or your score is too low.

- Check your credit report. Make sure there are no errors or old debts affecting your score.

- Call the reconsideration line. You can actually ask Amex to re-evaluate your application — sometimes they’ll approve you if you explain your situation or offer extra documentation.

- Wait and reapply later. After fixing the issues (like paying down debt or improving your score), try again in 3–6 months.

- Start with another Amex card. Sometimes, getting a lower-tier Amex first makes it easier to upgrade later.

Remember: a denial isn’t the end — it’s just feedback.

How to Maximize the Amex Blue Cash Preferred Card

Getting approved is just the first step. The real value of the Amex Blue Cash Preferred Card comes from knowing how to use it strategically. With the right habits, you can turn your everyday expenses into serious cashback — without changing how you spend.

Here are the smartest ways to make every dollar count and get the most from your card:

1. Focus on the 6% Categories

Buy your groceries with this card — especially at U.S. supermarkets (not big-box stores like Walmart or Target). You’ll earn 6% cashback until you hit $6,000 per year.

2. Add Your Streaming Services

Use this card for your Netflix, Hulu, Spotify, or Disney+ subscriptions. That’s another 6% back every month!

3. Use It for Gas and Transit

Every time you fill up your tank or take an Uber, you’ll get 3% cashback. Perfect for daily commuters.

4. Pay Your Full Balance Monthly

Never carry a balance unless you have to — the APR is high after the intro period, and interest can eat up your rewards.

5. Activate Amex Offers

Inside your Amex account, you’ll find special cashback deals (like 10% off certain brands). Activate them before shopping — it’s basically free money.

6. Hit the Welcome Bonus

Spend the required amount (usually $3,000 in 6 months) to get your $250 statement credit. Just don’t overspend — use it for bills or groceries you already planned to buy.

Is the Annual Fee Worth It?

Let’s be real — that $95 annual fee scares some people. But if you do the math, it’s actually easy to justify.

Example:

- Spend $500/month on groceries → $30 cashback monthly → $360 per year.

- Add $100/month on streaming + gas → about $84 per year.

That’s already $444 in cashback, minus the $95 fee = $349 in your pocket.

So yes, if you use it regularly for everyday spending, it totally pays for itself (and then some).

The Amex Blue Cash Preferred Card is perfect for regular people who spend big on groceries, gas, and streaming. It’s not about luxury or airline miles — it’s about getting real cash back for real life.

If you follow the tips in this guide, prepare your credit, and apply smartly, this card can become one of your most useful financial tools.

Just remember: cashback only matters if you manage your money wisely. Pay in full, stay on top of your credit, and let Amex work for you — not against you.