How The Platinum Card from American Express Works

Thinking about getting the famous Platinum Card from American Express but still not sure? Is it really worth that expensive annual fee, or is it just another flashy card in your wallet?

Advertisement

Stick around, because in this article we’ll break down everything you need to know — no fluff. From top-tier perks to the fees that might scare some people off. If you travel often or are looking to level up your card game, this is for you.

Advertisement

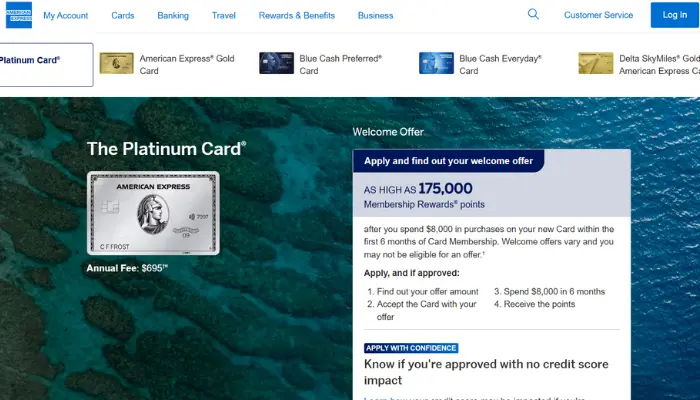

How to Apply for the Platinum Card?

Thinking the Platinum Card might be your next move? If the perks and travel benefits sound like your kind of thing, applying is actually way easier than most people imagine — and you can do it all online in just a few minutes.

But before you jump in, here’s the deal: American Express often has special welcome offers, and sometimes you can score up to 100,000 Membership Rewards points just for meeting a spending goal in the first few months. That’s a ton of value right off the bat — so don’t miss out on that bonus!

Advertisement

Here’s exactly how to apply:

Step-by-Step to Apply for the Platinum Card:

- Visit the official American Express website

Head over to americanexpress.com and look for “The Platinum Card.” - Click on “Apply Now”

This will take you straight to the application form. - Fill in your personal info

You’ll need your:- Full name

- Social Security Number (SSN)

- Estimated yearly income

- Address and contact details

- Submit and wait for a decision

In many cases, Amex gives you an answer instantly. If they need more time, they’ll email you with updates. - Get your card in the mail

Once approved, your shiny new Platinum Card should arrive in about 5 to 7 business days.

keep an eye out for welcome bonus offers. Sometimes they give you up to 100,000 Membership Rewards points if you spend a certain amount in the first 3 months.

What Is the Platinum Card from American Express?

The Platinum Card is one of Amex’s most premium cards. Not everyone has it, and it’s definitely not for everyone. But that doesn’t mean it’s impossible to get.

It’s designed for people who want a more complete experience in daily life and especially when traveling — like airport lounge access, credits at restaurants and apps, shopping protection, and more.

Of course, to get all this, you’ll need to pay a high annual fee. That’s why the card only makes sense if you really take advantage of the benefits.

What Are the Main Benefits of the Platinum Card?

This is where the Platinum Card really shows off. It’s not just a fancy-looking piece of metal — it comes packed with perks that can actually put money back in your pocket if you use them right.

That’s why so many people are okay with the high annual fee — because the value you get can easily make up for it (or even go beyond).

Let’s break down what you get as a Platinum Card holder:

1. Access to Premium Airport Lounges

Say goodbye to crowded terminals and overpriced airport snacks. With the Platinum Card, you get access to:

- Centurion Lounges (Amex’s exclusive lounges — seriously, they’re nice)

- Priority Pass lounges (1,300+ locations worldwide)

- Delta Sky Club (when flying Delta)

- Plus, other partner lounges globally

If you fly a few times a year, this alone can upgrade your whole travel experience.

2. Up to $400 in Travel and Ride Credits

- $200 Airline Fee Credit: Use it for seat upgrades, baggage fees, or in-flight snacks with a selected airline.

- $200 Uber Credit: You get $15 in Uber Cash each month plus a $20 bonus in December. Works for both Uber rides and Uber Eats.

That’s $400 back in your pocket — as long as you don’t forget to use it each month.

3. Hotel Status Without the Hassle

No need to rack up hotel nights to earn loyalty status — Amex does the work for you:

- Hilton Honors Gold

- Marriott Bonvoy Gold Elite

That means room upgrades (when available), late check-out, free Wi-Fi, and even free breakfast in some cases.

4. Full Travel Protection

Things go wrong when you travel — it’s just part of the deal. But this card has your back with:

- Trip delay insurance

- Trip cancellation and interruption coverage

- Baggage insurance

- Car rental loss and damage insurance

It’s peace of mind you don’t have to pay extra for.

5. 24/7 Concierge Service

Need help booking a table at that popular new restaurant? Want flowers delivered last minute? Need concert tickets?

The Platinum concierge is like a personal assistant on call — any time, any day.

6. VIP Hotel Experience with Fine Hotels + Resorts

When you book luxury hotels through Amex’s Fine Hotels + Resorts program, you unlock:

- Early check-in (no extra charge)

- Room upgrades (when available)

- Free daily breakfast

- Guaranteed 4 p.m. late check-out

- Extra perks like spa credits or welcome gifts

Perfect for turning a weekend getaway into something that feels like first class.

In short? If you’re someone who travels regularly, likes to treat yourself, or wants a card that gives back real value — these benefits can easily make the Platinum Card worth it. Just make sure you actually use what it offers. Leaving credits or perks on the table is like tossing money out the window.

What Are the Fees and Annual Cost in 2025?

Let’s be real, this is the part that makes a lot of people pause. The Platinum Card isn’t cheap, and the annual fee in 2025 is $695. That’s a big number, especially if you’re not used to paying for a credit card.

But here’s the thing: this card isn’t about saving a few bucks here and there. It’s built for people who want perks, protection, and premium experiences, especially when it comes to travel.

And if you actually take advantage of everything the card gives you (like credits, insurance, airport lounges, and hotel upgrades), that $695 can pay for itself — and then some.

Here’s what else you need to know:

- Additional cards (for authorized users) cost $195 each — and you can add up to 3 for that price.

- No foreign transaction fees, which means you can use it internationally without extra charges.

Bottom line? It’s expensive, yes. But if you’re using the perks, it can be a great return on investment.

How Do Points Work with the Platinum Card?

One of the biggest reasons people get the Platinum Card is for the Membership Rewards program — Amex’s way of rewarding you for spending. And when used right, these points can turn into serious value, especially if you love to travel.

Whether you’re booking flights, staying in hotels, or just handling your day-to-day purchases, this card helps you rack up points fast. And the best part? You’ve got options when it comes to using them — from free trips to statement credits.

Let’s break down exactly how you earn points and how to make the most of them.

Here’s how you earn:

- 5x points per dollar on flights booked directly with airlines or through Amex Travel.

- 5x points on hotels booked through Amex Travel.

- 1x point on everything else.

And here’s how you can use them:

- Redeem for flights, hotels, upgrades, gift cards, or even statement credits.

- Transfer to travel partners (airlines and hotels), which often gives you better value.

Pro tip: don’t redeem for physical products — they usually offer less value. Travel redemptions give you the best bang for your buck.

Is the Platinum Card Good for Travel?

If there’s one area where the Platinum Card truly stands out, it’s travel. This card wasn’t made just to sit in your wallet — it was made to move.

Whether you fly a few times a year or you’re always planning your next getaway, the travel perks on this card can completely change how you experience trips.

Here’s what you get when it comes to travel:

1. Lounge Access Around the World

No more waiting at crowded airport gates. With the Platinum Card, you can relax in over 1,300 airport lounges worldwide, including:

- Centurion Lounges (exclusive to Amex)

- Priority Pass lounges

- Delta Sky Clubs (when flying Delta)

It’s free food, drinks, Wi-Fi, comfy chairs — everything to make travel less stressful.

2. Built-In Travel Insurance and Coverage

Stuff happens. Delays, cancellations, lost bags — and those can cost you. But with this card, you’re protected:

- Trip delay and cancellation coverage

- Lost or delayed baggage insurance

- Emergency medical support

- Rental car damage protection

Travel with peace of mind knowing you’re covered without paying extra for third-party insurance.

3. Luxury Hotel Perks

When you book through Amex’s hotel programs (like Fine Hotels + Resorts), you unlock VIP treatment:

- Early check-in and late check-out

- Free room upgrades (when available)

- Complimentary breakfast for two

- $100+ in hotel credits for dining or spa

It feels like you’re getting a 5-star experience, even if you’re staying for just one night.

4. No Foreign Transaction Fees

Traveling abroad? Use your card freely. The Platinum Card doesn’t charge any extra fees for international purchases — something many basic credit cards still do.

Who Can Apply for the Platinum Card?

The Platinum Card isn’t your average starter card — and American Express doesn’t hide that. This one’s made for people who already têm um certo histórico com crédito e estão prontos pra jogar em outro nível.

Amex doesn’t lay out strict public requirements, but based on real-world data and user experiences, we’ve got a pretty solid idea of what they usually look for. If you’re thinking about applying, it’s good to know where you stand before hitting that “Apply Now” button.

Here’s what most successful applicants tend to have:

- Good to excellent credit score (usually 700+).

- Stable income, ideally over $60k/year.

- Clean payment history with no recent late payments.

- Some credit history with other cards, preferably without high revolving debt.

Already have an Amex card or a strong relationship with your bank? That improves your chances.

How to Activate and Use the Card’s Credits

One of the biggest mistakes people make with the Platinum Card is simple — they forget to activate or use the credits that come with it. And when that happens, you’re basically leaving money on the table.

These credits are a huge part of what makes the $695 annual fee worth it. But Amex doesn’t just apply them automatically in most cases — you need to manually activate them and use the card with the right services.

No worries, though. Here’s a quick step-by-step to make sure you don’t miss out:

Step-by-Step: How to Use Your Amex Platinum Credits

- Log into your American Express account

Use either the website or mobile app. - Go to the “Benefits” section

This is where all your available credits are listed. - Activate each credit

Some credits require a one-time activation — like Uber, digital entertainment, or airline fees. - Use your Platinum Card with eligible merchants

Make sure you’re using the card where it counts (only specific brands or categories qualify). - Watch for the credit on your statement

After the purchase, you’ll typically see a statement credit applied within a few days.

Most Popular Credits Available with the Platinum Card

Here are the most valuable (and commonly used) credits that come with your card:

- $200 in Uber Credits per Year

You’ll get $15 in Uber Cash each month, plus an extra $20 in December. Works for both Uber rides and Uber Eats. - $200 Airline Fee Credit

Pick one airline per year and use the credit for things like baggage fees, seat selection, or in-flight snacks. - $240 in Digital Entertainment Credits

Get up to $20 per month for eligible streaming services and Wi-Fi platforms (like Disney+, Peacock, Hulu, and others). - $189 CLEAR Plus Credit

Use this to cover your CLEAR membership — a service that helps you skip long lines at airport security.

These credits can easily add up to more than the annual fee, but only if you use them regularly. So, the key is to activate everything as soon as you get the card, set reminders if needed, and check your account monthly to make sure you’re not leaving money behind.

Are There Any Downsides to the Platinum Card?

Yep, even a premium card like the Platinum has a few downsides. And it’s important to know them upfront, so você não entra numa furada achando que é só glamour.

The truth is, this card isn’t for everyone. While it comes with a ton of perks, there are a few things that might be deal-breakers depending on your lifestyle and how you manage your money.

Here are the main cons to watch out for:

1. High Annual Fee

The $695 annual fee is no joke. If you’re not using the travel perks, credits, or lounges often, you might end up paying for stuff you don’t actually use. That’s money down the drain.

2. Rewards System Isn’t Simple

The Membership Rewards program can be super valuable — but only if you understand how to use it right. Transferring points to travel partners, avoiding low-value redemptions, and keeping track of categories can feel confusing for some folks.

3. Limited Acceptance

Not every store takes American Express, especially smaller shops, local businesses, and even some restaurants. So it’s always smart to have a backup card from Visa or Mastercard, just in case.

4. Geared Toward Frequent Travelers

Let’s be honest — most of the Platinum Card’s value comes from travel perks. If you don’t fly much, stay in hotels, or use airport lounges, this card might not be the best fit for your everyday life.

The Platinum Card is powerful, but only if it matches how you live and spend. If you’re not using the perks, it quickly turns from a smart tool into an expensive mistake.

Is the Platinum Card Safe to Use?

Worried about security? You don’t need to be. When it comes to keeping your money and personal info protected, American Express is one of the best in the game.

The Platinum Card comes with strong safety features built-in, so you can swipe, tap, and shop with peace of mind — whether you’re online, traveling, or just grabbing groceries.

Here’s what you get with Amex security:

- Real-time alerts via app or text.

- Zero liability for fraud — they take care of any weird charges.

- Contactless and chip technology.

- 24/7 customer support for any emergencies.

If something goes wrong, they’ve got your back.

Is the Platinum Card from Amex Worth It?

The truth is, whether the Platinum Card is worth it or not really comes down to how you live and spend. It’s not a one-size-fits-all card — it works amazingly well for some people and just doesn’t make sense for others.

To help you decide, here’s a quick breakdown:

It’s probably worth it if:

- You travel at least a couple of times a year — even just within the U.S.

- You enjoy perks like airport lounges, hotel upgrades, and early check-in.

- You plan to use the monthly and yearly credits (Uber, streaming, airline fees, etc.).

- You like earning and using travel points for flights, hotels, or upgrades.

It’s probably not worth it if:

- You rarely travel and don’t care about luxury perks.

- You prefer a simple, no-hassle cashback card.

- You don’t want to keep track of rewards, credits, or benefit deadlines.

If you fall into the first group and are willing to take full advantage of what the card offers, the Platinum can easily pay for itself and give you a more comfortable, rewarding lifestyle — especially when you’re on the move.

But if none of the perks fit your routine, there are simpler and cheaper cards out there that may serve you better.

If you travel often and use the perks, the Platinum Card can give you way more value than the $695 fee. Lounge access, hotel upgrades, and travel credits can easily pay off.

But if you’re not into traveling or don’t want to manage rewards, there are simpler cards that make more sense.

In the end, it all comes down to how you live — and how you spend.