Learn How to Build Credit with the Discover it Student Cash Back

If you are a student and considering getting a credit card, you have probably heard of the Discover it Student Cash Back. This card is one of the most popular options for those starting to build credit and looking to take advantage of benefits like cashback on everyday purchases.

Advertisement

But is it really worth it? How does the rewards program work? What are the requirements to get one? If these questions have crossed your mind, don’t worry! Here, we’ll explain everything about the Discover it Student Cash Back in a simple and straightforward way.

Advertisement

What is the Discover it Student Cash Back?

If you are a college student in the U.S. and looking for your first credit card with real benefits, the Discover it Student Cash Back can be an excellent option.

Designed specifically for those who are still building their credit history, it combines easy approval with an attractive rewards program.

Advertisement

The biggest advantage of this card is the cashback: it gives back up to 5% of the amount spent in selected categories each quarter and 1% on all other purchases. This means that, in addition to making purchases as usual, you also get a portion of your money back.

If you have never had a credit card before, this can be a great starting point because:

- No annual fee, meaning you don’t have to pay to keep the card active.

- Helps build credit, which is essential for renting an apartment, financing a car, or even getting a job in the future.

- Offers cash rewards, which can be used to pay your bill or for any other expense.

In addition to being an accessible card for students, it allows you to learn how to manage credit responsibly while enjoying financial benefits.

How Does the Cashback Program Work?

One of the biggest attractions of the Discover it Student Cash Back card is its rewards program, which allows you to receive a portion of your spending back. When used strategically, this benefit can lead to significant savings in your daily expenses.

The program works as follows:

1. 5% cashback in rotating categories – Every quarter (three months), Discover defines specific categories where you can earn 5% cashback on your purchases. These categories change throughout the year and may include:

- Supermarkets

- Gas stations

- Restaurants

- Amazon and other online stores

To maximize your cashback, you must activate the category on the Discover website or app.

2. 1% cashback on all other purchases – If a purchase does not fit into the quarterly categories, you still earn 1% cashback on the amount spent.

3. Cashback Match in the first year – At the end of the first 12 months, Discover doubles the total cashback you’ve earned. This means that if you received $100 in cashback throughout the year, Discover adds another $100, increasing your rewards to $200.

With good planning, the Discover it Student Cash Back card can help reduce expenses over time. If you take advantage of the right categories, you can maximize your earnings and make your money go further.

Requirements to Apply for the Discover it Student Cash Back

Before applying for the Discover it Student Cash Back, it is important to check whether you meet the requirements set by the financial institution. This card is designed for college students in the United States, and the approval conditions are relatively accessible.

To be eligible, you must:

- Be a college student in the U.S. – The card is intended for those enrolled in a college or technical program in the country.

- Have a Social Security Number (SSN) or ITIN – Essential for Discover to verify your identity and register your credit history.

- Be at least 18 years old – The minimum age required to apply for a credit card in the U.S.

- No prior credit history required – This is one of the key advantages of the Discover it Student Cash Back card, making it a great option for those applying for a credit card for the first time.

Since no previous credit experience is required, this card can be an excellent starting point for students looking to build a solid financial history from an early stage.

How to Apply for the Card?

If you meet the requirements, you can apply for the Discover it Student Cash Back quickly and easily without leaving home. The process is entirely online and takes only a few minutes.

Follow these steps to apply for the card:

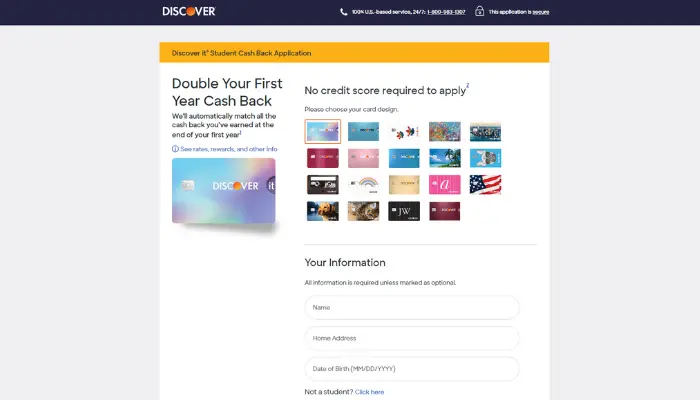

- Go to the official Discover website and navigate to the Discover it Student Cash Back page.

- Click on “Apply Now” to start the application process.

- Fill out the form with your personal information, including name, address, Social Security Number (SSN) or ITIN, income, and details about the college you attend.

- Review all information to ensure accuracy before submitting your application.

After submission, Discover may approve your application immediately or request additional information for review. If approved, the card will be sent to your registered address and should arrive within 7 to 10 business days.

Additional Benefits of the Discover it Student Cash Back

In addition to the cashback program, the Discover it Student Cash Back offers a range of benefits that make it an even more attractive option for college students.

Since many are applying for a credit card for the first time, Discover has included features that help make this experience safer, more accessible, and more rewarding.

With benefits ranging from no annual fee to credit monitoring tools, this card allows you to start building a solid financial history without straining your budget.

Additionally, fraud protection and payment flexibility provide extra peace of mind when dealing with unexpected situations.

Check out the key additional benefits that make the Discover it Student Cash Back stand out among student credit cards.

- No annual fee – There is no charge to keep the card active, meaning you can use it without worrying about annual fees.

- Free access to FICO Score – Monitoring your credit score is essential to understanding how to improve your credit history and secure better opportunities in the future.

- Fraud protection – If any suspicious activity occurs on your card, you will not be held responsible for unauthorized purchases, ensuring more security.

- Payment flexibility – If you miss a payment for the first time, Discover waives the late fee. However, paying on time is essential to avoid interest and maintain a good credit history.

These benefits make the card an excellent option for students seeking financial security, convenience, and rewards while building a solid credit history.

Limitations and Disadvantages

While the Discover it Student Cash Back card offers many benefits, it is important to understand its limitations before making a decision. Like any credit card, it has some aspects that may not be ideal for every student.

Here are some disadvantages to consider:

- 5% categories are limited – To earn the highest cashback rate, you must manually activate the rotating categories each quarter. If you forget to activate them, purchases in those categories will only earn 1% cashback.

- High APR after the promotional period – For the first six months, the APR is 0%, but after that, it can range from 17% to 26%, depending on your credit. To avoid interest charges, always pay the full statement balance.

- Limited acceptance – Although Discover is widely accepted in the U.S., it does not have the same coverage as Visa or Mastercard. Some merchants may not accept this card, so it is always good to have an alternative available.

Despite these limitations, the Discover it Student Cash Back remains one of the best options for students, especially those new to credit and looking to earn rewards without paying an annual fee.

How to Maximize Cashback and Card Benefits?

To make the most of the benefits of the Discover it Student Cash Back, it’s important to adopt smart strategies when using the card. Since cashback varies according to rotating categories, planning your spending strategically can increase your rewards effortlessly.

Here are some tips to maximize earnings and get the most out of your card:

- Activate the 5% categories each quarter – Discover requires cardholders to manually activate the rotating cashback categories. To ensure you always take advantage of the highest rewards rate, keep an eye on notifications in the Discover app or website.

- Use the card for essential purchases – Some of the most common cashback categories include supermarkets, gas stations, and restaurants. If these expenses are part of your daily routine, prioritizing the use of your Discover card for these purchases can significantly boost your rewards.

- Always pay the full statement balance – Cashback can be a great benefit, but paying interest can completely cancel out your savings. To ensure you’re truly saving money, pay your statement balance in full every month and avoid carrying a high-interest balance.

- Take advantage of the Cashback Match in the first year – Since Discover doubles the cashback earned in the first year, using the card frequently during this period can result in even greater returns. If possible, concentrate your spending on the Discover card to maximize this advantage.

With these strategies, the Discover it Student Cash Back can become a valuable tool for saving money and building a solid credit history over time.

If you’re a student looking to build credit with no annual fee and earn cashback, the Discover it Student Cash Back is one of the best options available.

It offers rewards, security, and benefits that can make a big difference in your daily life. The key is to use it responsibly, pay on time, and take full advantage of the 5% categories.

Enjoyed this article? Share it with your friends who also want to learn about student credit cards!