Citi Diamond Preferred: Is This Credit Card Worth Choosing?

If you are researching the Citi Diamond Preferred, you’ve probably heard that it’s one of the most popular credit cards for those looking for simplicity and low rates.

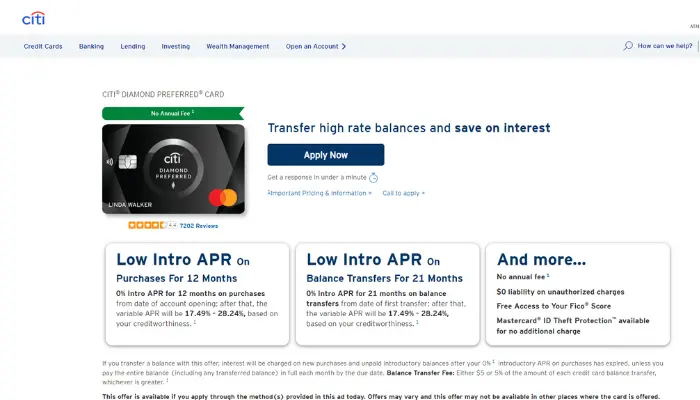

Advertisement

And it’s true! This card is known for helping those who want to save money, especially when paying off debts or organizing their finances.

Advertisement

We’ll explain everything you need to know about it, without any fluff and in a simple, easy-to-understand way.

What is the Citi Diamond Preferred?

The Citi Diamond Preferred is a credit card offered by Citibank, known for being simple and practical. It’s perfect for anyone looking to get rid of high-interest rates on other cards or make big purchases without worrying about upfront fees.

Advertisement

This card focuses on balance transfers and an introductory 0% APR rate, meaning you can save a lot of money in the beginning.

The ideal audience for this card includes people who want to consolidate debts or make a big purchase and pay it off gradually without interest during the promotional period.

It’s not a card focused on rewards or cashback, but it’s excellent for those seeking low rates and exclusive benefits, like access to events and a 24/7 concierge service.

Key Benefits of the Citi Diamond Preferred

If you’re looking for a card that truly helps you save and makes your life easier, the Citi Diamond Preferred is an excellent choice.

Although it doesn’t offer traditional rewards, it provides advantages that make all the difference for those who want to cut costs, manage their finances, or even access premium services without overspending.

Check out the main benefits:

- 0% APR Introductory Rate: During an initial period (typically 21 months for balance transfers and 12 months for purchases), you won’t pay any interest. Perfect for consolidating debt or making large purchases.

- No Annual Fee: That’s right, you don’t have to worry about paying an annual fee to keep the card.

- 24/7 Concierge Service: This special service helps you book hotels, event tickets, or even plan trips.

- Access to Exclusive Events: With the Citi Diamond Preferred, you can enjoy VIP experiences like concerts, sports events, and more.

If you’re tired of paying high-interest rates or just want a card with no annual fee, this is one of the best options out there.

Fees and Charges Associated with the Citi Diamond Preferred

Before applying for any credit card, it’s essential to fully understand the fees and charges involved. This helps you use the card strategically, avoiding surprises or unexpected costs.

While the Citi Diamond Preferred offers attractive benefits, there are some fees to keep an eye on to make the most of it without overspending.

Here’s an overview of what to expect:

- Regular Interest Rate: After the promotional period, the APR ranges from 17.99% to 27.74%, depending on your credit history.

- Balance Transfer Fee: Even with the 0% APR, there is a fee of 5% (or at least $5 per transfer) on the transferred balance.

- Additional Fees: Late payments or exceeding your card limit may incur extra costs. Additionally, there’s a 3% fee for foreign transactions.

Be mindful of these fees and use the card wisely to take full advantage of its benefits without surprises at the end of the month.

How Does Balance Transfer Work with the Citi Diamond Preferred?

Balance transfer is one of the biggest attractions of the Citi Diamond Preferred. With it, you can move the balance from another credit card to this one and take advantage of the 0% APR promotional period, paying no interest. It’s ideal for consolidating debt and saving money.

How to Make a Balance Transfer:

- Check the balance and rates on your current card: Review how much you owe and the interest rates you’re paying.

- Apply for the Citi Diamond Preferred: Ensure your application is approved before transferring the balance.

- Request the transfer: Log into your online account or call Citi support to request the balance transfer from the other card to the Citi Diamond Preferred.

- Pay installments on time: Use the 0% APR period to pay off your debt without worrying about high interest.

Rewards Program: Is There One?

Here’s the reality: the Citi Diamond Preferred doesn’t offer traditional rewards like cashback or points. This might be disappointing if you enjoy earning miles or cashback, but it’s the trade-off for simplicity and lower rates.

If you value rewards, a tip is to pair the Citi Diamond Preferred with another Citi card that has a cashback or points program. That way, you can use the Diamond Preferred for balance transfers or large purchases and the other card for your daily expenses.

How to Apply for the Citi Diamond Preferred?

Applying for the Citi Diamond Preferred is a quick and straightforward process, but being prepared can increase your chances of approval.

First, it’s important to know that this card is designed for those with a solid financial history and good credit. If you meet the requirements, you’re just a few steps away from getting this card.

Approval Requirements:

- Recommended credit score: Good or excellent (generally above 700).

- Stable financial history.

- Income that meets Citibank’s requirements.

Step-by-Step Guide to Apply:

- Visit the Citi website: Access the official Citi Diamond Preferred page.

- Fill out the application form: Provide your personal details, such as name, address, income, and credit history.

- Review and submit: Double-check all the information and submit your application.

- Wait for approval: The response may come within minutes or take a few days.

Who Should Choose the Citi Diamond Preferred?

The Citi Diamond Preferred is the perfect card for those seeking simplicity and savings, especially if you’re looking to organize your finances or avoid paying high-interest rates.

It’s not about rewards or miles, but it’s excellent for specific goals. Here’s who can benefit most:

- Those consolidating debt: If you’re paying high interest on other cards, transferring the balance to the Citi Diamond Preferred can be a smart move, thanks to its 0% APR promotional rate.

- People planning large purchases: This card is ideal for financing big purchases and paying them off gradually, without interest during the introductory period.

- Those who prefer simplicity: If you want a card with no annual fee and no complicated rewards programs, the Citi Diamond Preferred is for you.

However, if you’re looking for robust cashback programs, points, or travel perks, other cards might be a better fit. The Citi Diamond Preferred is straightforward: great for saving and easy to use.

How Long Does the 0% APR Introductory Rate Last?

Up to 21 months for balance transfers and 12 months for purchases, giving you plenty of time to organize your finances without worrying about interest.

Is There a Welcome Bonus?

No, the Citi Diamond Preferred doesn’t offer a welcome bonus, as its focus is on low rates and benefits like the 0% APR balance transfer offer.

Can I Use the Card for International Purchases?

Yes, you can use the Citi Diamond Preferred for international purchases, but there is a 3% foreign transaction fee. Consider this cost when planning expenses abroad.

What’s the Best Way to Use the Concierge?

To make the most of the 24/7 concierge service, simply call the number on your card. They can assist with hotel reservations, event tickets, and even travel planning, adding convenience to your life.

Final Tips for Making the Most of the Citi Diamond Preferred

If you want to take full advantage of everything the Citi Diamond Preferred offers, here are a few simple but effective strategies to maximize its benefits without overspending:

- Pay off your balance during the introductory period: Avoid unnecessary interest charges after the promotional period ends.

- Avoid using it for international purchases: The 3% foreign transaction fee can add up quickly.

- Combine it with another card: Use the Citi Diamond Preferred for balance transfers and pair it with a rewards card for everyday purchases.

With these tips, the Citi Diamond Preferred can become a powerful tool to help you organize your finances and save as much as possible!

If you’re thinking about getting your finances in order, the Citi Diamond Preferred could be the ideal partner. It’s simple, economical, and designed to help you save on interest and fees.

Now that you know everything about it, you’re ready to decide if it’s the right card for you!