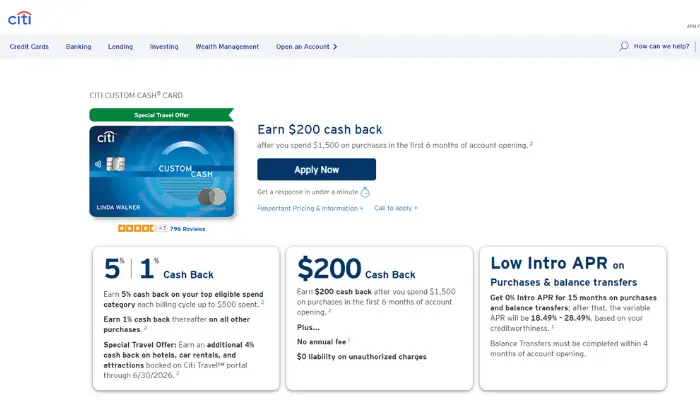

Discover the Benefits of the Citi Custom Cash: Apply Now!

If you are always on the lookout for ways to save while spending, you’ve probably heard about the Citi Custom Cash.

Advertisement

This credit card has been making waves for being super flexible and offering cashback in categories that automatically adjust to your lifestyle.

Advertisement

But is it really all that? And most importantly, is it worth it for you? Let’s uncover all the details, explain how it works, and share the best tips to help you make the most of it. Shall we?

What is the Citi Custom Cash Card?

The Citi Custom Cash is a credit card from Citi Bank that offers a unique cashback system.

Advertisement

With it, you can earn up to 5% back on your purchases, but the most interesting part is that the category where this cashback applies changes according to your spending. No need to manually choose — the card does it for you!

In other words, it adapts to your spending habits. If you tend to spend more on groceries one month and more on gas the next, the Citi Custom Cash automatically adjusts the 5% category to where you spent the most.

This makes it an excellent choice for anyone looking to maximize benefits without much hassle.

How Does the Citi Custom Cash Work?

The Citi Custom Cash is the perfect card for anyone seeking convenience and benefits without complications.

The standout feature of this card is its adaptable cashback system, which automatically adjusts the top benefit category based on your spending habits.

This means you don’t have to stress about selecting categories or activating offers — the card does all the work for you!

Here’s how it works in practice:

- 5% cashback: automatically applied to the category where you spent the most in a month, up to a $500 limit.

- 1% cashback: valid for all other purchases, with no spending limit.

The categories included cover restaurants, groceries, gas stations, gyms, public transportation, travel, and more. For example, if you spend $400 on groceries and $300 on gas in one month, the 5% cashback will automatically apply to the $400 spent on groceries. It’s easy — no extra steps needed beyond using the card.

And there’s more: the cashback is accumulated as ThankYou points, which you can use to pay bills, redeem as cash, or even for travel. In other words, savings that turn into flexibility!

Fees and Conditions

Before applying for any credit card, it’s always good to understand the rules of the game. With the Citi Custom Cash, it’s no different: there are some conditions you need to know to make the best use of it.

The good news is that it won’t hurt your wallet since it has no annual fee — quite a relief, right?

Additionally, the interest rates (APR) are determined based on your credit profile, and there are some fees for specific situations, such as international transactions or cash advances.

Let’s break it all down so you can stay informed and avoid surprises.

If you don’t usually travel abroad, the extra fees won’t be an issue, making this card a great choice for everyday use. Now, let’s get to the numbers!

- Annual Fee: None! Yes, the Citi Custom Cash has no annual fee, which is a huge plus.

- Interest Rate (APR): ranges from 18.74% to 28.74% annually, depending on your credit profile.

- Extra Fees:

- International transactions: 3%.

- Cash advances: 5% of the cash amount or $10 (whichever is greater).

If you frequently travel abroad, the international transaction fee might not be very advantageous. However, for everyday use, the conditions are quite fair.

Exclusive Benefits and Features

The Citi Custom Cash goes beyond the 5% cashback. It also offers a range of perks that can add security and convenience to your daily life.

These extra benefits show that this card isn’t just about saving money but also about adding value to your experience as a consumer. Take a look at the main features it offers:

- Purchase protection: Bought something that was stolen or damaged shortly after? Citi can help you recover the value, ensuring you’re not left at a loss.

- Extended warranty: When you purchase items with the card, the manufacturer’s original warranty gets an extra period added. This means more peace of mind for your important purchases.

- Rewards that never expire: The ThankYou points you accumulate with cashback have no expiration date, giving you the freedom to save up before deciding how to use them.

These benefits are perfect for those looking for more security in daily life and wanting to use the card in ways that go beyond just purchases. After all, who doesn’t like a little extra help when things don’t go as planned?

How to Apply for the Citi Custom Cash

Decided that the Citi Custom Cash is the right card for you? Then it’s time to understand how to apply simply and quickly. The good news is that the process is entirely online and straightforward, without any hassle.

You just need to gather some information, fill out a form, and wait for the bank’s review.

Before starting, it’s worth noting that this card requires a good or excellent credit score (usually above 670).

If you have a clean credit record and your bills are up to date, your chances of approval increase significantly. Now, let’s go step-by-step to secure your Citi Custom Cash!

- Check your credit: The Citi Custom Cash requires a good or excellent credit score (usually above 670).

- Visit Citi’s website: Go to the card’s official page.

- Fill out the form: Provide information such as full name, address, annual income, and SSN.

- Submit the required documents: Typically, proof of income or identification is requested.

- Wait for the review: The bank will analyze your credit profile and, in some cases, may request additional information.

- Await approval: If approved, the card will be sent to your address.

Extra tip: Keep your bills paid on time before applying for the card to improve your chances of approval.

Strategies to Maximize Cashback

If you want to make the most out of the cashback offered by the Citi Custom Cash, it’s essential to use some smart strategies.

Since the card’s system is already adaptable, the heavy lifting is done for you, but with a little planning, you can enhance the benefits even further. Here are some practical tips to boost your cashback:

- Organize your spending: Focus your largest expenses on a single category each month. For example, in January, make all your grocery purchases with the Citi Custom Cash.

- Combine with other cards: Use other cards for categories that don’t qualify for the 5% benefit.

- Monitor your limits: Remember that the 5% cashback only applies to the first $500 per month.

- Plan bigger purchases: If you know you’ll spend a lot on something, adjust your habits so that it falls under the primary category for the month.

The Citi Custom Cash is an excellent option for those who want a hassle-free card with straightforward benefits for everyday use. It adapts to your spending habits, has no annual fee, and offers cashback that can make a real difference in your budget.

Of course, it has its limitations, such as the $500 cap for 5% cashback and the fee for international transactions, but overall, it’s a highly advantageous card for domestic spending.

If you’re looking for a card that saves while you spend, the Citi Custom Cash might be an excellent choice. Ready to take advantage of it?