Learn About Chase Freedom Unlimited and Start Saving!

If you’re looking for a credit card that offers incredible benefits, hassle-free usage, and helps you save money, the Chase Freedom Unlimited might be exactly what you need.

Advertisement

But before rushing to apply for a new card, it’s important to understand how it works, what the benefits are, and even the potential costs. So, let’s dive into this complete and super-simple guide!

Advertisement

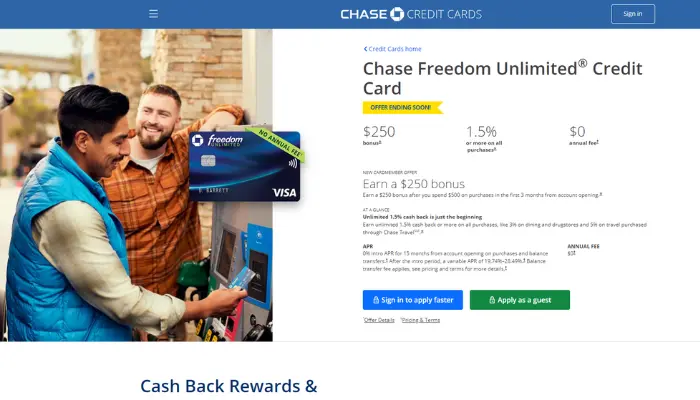

What is the Chase Freedom Unlimited Card?

The Chase Freedom Unlimited is one of Chase’s most popular credit cards, and it’s no wonder! It’s ideal for those who want to take advantage of a straightforward and easy cashback system.

The target audience for this card includes people who spend regularly across various categories and want something practical to accumulate rewards.

Advertisement

The big appeal of the Chase Freedom Unlimited is that it combines solid benefits, such as cashback on all purchases, without requiring you to manage rotating categories or sign up for promotions each quarter.

Main Benefits of the Chase Freedom Unlimited

If there’s one reason why the Chase Freedom Unlimited is so popular, it’s because it delivers exactly what many people look for: real advantages, easy to understand, and that make a difference in your budget.

Whether you’re someone who enjoys earning rewards effortlessly or someone who wants to avoid unnecessary fees, this card has something special to offer.

Let’s take a look at the key benefits that make this card such an attractive choice:

- Unlimited Cashback: With every purchase, you earn a percentage of the amount back, and the best part: no earning limits!

- No Annual Fee: Unlike many premium cards, you pay nothing to keep this card active.

- Attractive Introductory Offer: They usually offer 0% APR for 15 months on purchases and balance transfers.

- Purchase and Travel Protections: Purchase insurance, fraud protection, and assistance during travel emergencies.

- Welcome Bonus: Many users report receiving a generous welcome bonus, such as $200 after spending a minimum amount within the first 3 months.

How Does the Chase Freedom Unlimited Cashback Work?

Who doesn’t love getting a little money back on everyday purchases? That’s exactly what the Chase Freedom Unlimited offers, and it’s super easy to understand.

The cashback system is designed to help you maximize your spending, no matter what you’re buying. Let’s break down how it works!

Different Cashback Rates

One of the biggest advantages of this card is that you earn different cashback rates depending on the purchase category. Here’s how it works in practice:

- 5% cashback: On travel purchases made directly through the Chase Travel Portal. This includes flights, hotels, and even car rentals.

- 3% cashback: On purchases at pharmacies and restaurants, including delivery orders. Perfect for those who spend a lot on food and health-related items.

- 1.5% cashback: On all other purchases, with no restrictions. This includes groceries, gas, online shopping, and much more.

This system is perfect for those who want to accumulate cashback without worrying about temporary promotions or rotating categories.

Simple and Flexible Redemption

The cashback you earn can be redeemed in several ways, all very practical. Here are the options:

- Statement Credit: Use your cashback to reduce your total bill.

- Bank Transfer: Transfer the cashback directly to your bank account.

- Chase Portal: Redeem your rewards for travel, products, or gift cards.

And here’s the best part: there’s no minimum amount required to redeem your rewards. Even if you’ve only accumulated one dollar, you can use it. This makes the program even more accessible and easy to enjoy.

The Chase Freedom Unlimited cashback system is one of the simplest and most efficient on the market, ideal for those who want to earn rewards without complication.

Fees and Charges

Having a credit card with no annual fee is already a relief, but that doesn’t mean it’s entirely free of charges. Like any other card, the Chase Freedom Unlimited has some fees you should be aware of to avoid unpleasant surprises on your bill.

After all, nobody wants to pay more than necessary, right? Let’s break down the main fees so you can use the card wisely and confidently:

- Regular APR (Interest Rate): After the 0% introductory period, the interest rate can vary based on your credit score. Generally, it ranges between 20.24% and 28.99%.

- Foreign Transaction Fee: A drawback for frequent travelers: the Chase Freedom Unlimited charges 3% on transactions made outside the U.S.

- Late Fees and Penalties: Late payments or exceeding your credit limit may result in additional charges.

Who Should Choose the Chase Freedom Unlimited?

The Chase Freedom Unlimited is the type of card that works well for a variety of consumer profiles.

If you’re looking for something practical that offers consistent rewards without the hassle of rotating categories or annual fees, it could be the right choice for you.

But to help even more, here’s a list of who might benefit the most from this card:

- People who make diverse purchases and want fixed rewards.

- Those who prefer a card with no annual fee.

- Frequent spenders at pharmacies and restaurants.

- Travelers who often move within the U.S. (but not as much internationally).

If any of these profiles sound like you, the Chase Freedom Unlimited is worth considering as your next credit card. It delivers convenience, advantages, and helps you save effortlessly!

How to Apply for the Chase Freedom Unlimited?

Impressed with everything the Chase Freedom Unlimited has to offer? Then it’s time to learn how to apply for one! The good news is that the process is super simple and quick.

Just follow these basic steps to submit your application, and in no time, the card will be in your hands, ready to use. Here’s the complete guide to make sure everything goes smoothly:

- Check Your Credit:The Chase Freedom Unlimited requires a good credit history. Before applying, check your score on free credit reporting sites.

- Visit the Chase Website:Go to the official Chase site and look for the Chase Freedom Unlimited page.

- Complete the Application Form:

- Personal information (name, address, phone number).

- Financial details (annual income, employment status).

- Submit Your Application:After filling everything out, click submit. You may receive an instant response or need to wait a few days.

- Track Your Application:If your application is approved, the card usually arrives within 10 business days.

Advantages and Disadvantages of the Chase Freedom Unlimited

Like any credit card, the Chase Freedom Unlimited has its strengths and some limitations. Before deciding if it’s the right choice for you, it’s important to understand what it does well and where it might fall short.

Let’s go over the pros and cons to help you make an informed decision:

Advantages:

- Simple and attractive cashback.

- No annual fee.

- Extra benefits like insurance and purchase protections.

Disadvantages:

- Foreign transaction fees.

- High-interest rates after the introductory period.

If you’re looking for a practical card with easy cashback and extra benefits, the Chase Freedom Unlimited is a great option.

However, for those who travel frequently abroad or tend to carry monthly balances, it’s worth considering these drawbacks before making a decision.

If you’re after a simple card with no annual fee, great cashback benefits, and purchase and travel protections, the Chase Freedom Unlimited is an excellent choice. It’s ideal for those looking to save on everyday expenses and accumulate rewards without complications.

That said, if you travel extensively abroad or prefer cards with rotating categories offering high cashback rates, it might be worth exploring other options. The key is to understand what you really need and choose the card that best fits your lifestyle.

Now that you know everything about the Chase Freedom Unlimited, it’s time to decide if it’s the right card for you!