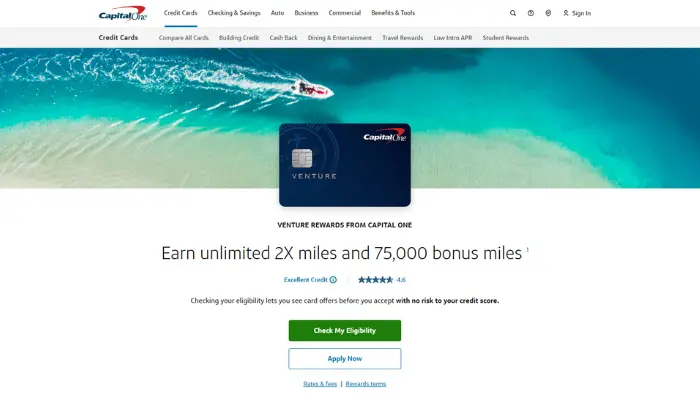

Capital One Venture Rewards Explained

The Capital One Venture Rewards is one of the most popular travel cards in the U.S. because it offers simple, consistent rewards without complicated categories.

Advertisement

You earn miles on almost every purchase and use them however you prefer — easy and straightforward.

Advertisement

Before applying, it’s important to understand the fees, benefits, how the miles work, and the application process.

Here’s everything you need to know in a clear and simple way.

Advertisement

How to Apply for the Capital One Venture Rewards

This is the first thing most people want to know. The good news is that the application process

is quick, online, and in many cases, the decision comes instantly.

But before hitting Apply Now, it’s important to understand what the bank usually looks for

and what increases your chances of approval.

Basic Requirements for a Higher Chance of Approval

- Having good or excellent credit makes approval much easier.

- Having stable income, even if it’s not very high.

- No recent late payments on other accounts.

- Keeping credit utilization low (ideally under 30%).

Step-by-Step: How to Apply

- Go to the official Capital One website

Access the page for the Capital One Venture Rewards Credit Card. - Click “Apply Now”

You’ll be directed to the online application form. - Fill in your personal information

Name, address, income, employment info, and your SSN. - Review the card terms

Check the annual fee, APR, and all terms before submitting. - Submit your application

Many applicants get an instant answer. - Receive your card in the mail

If approved, your card arrives within a few business days.

Tips to Increase Approval Chances

- Pay down balances on other credit cards before applying.

- Avoid applying for multiple cards at the same time.

- Update your total income (including declared side hustles).

- Check your credit score beforehand.

What Is the Capital One Venture Rewards?

The Capital One Venture Rewards is a travel-focused credit card designed for people who want

to earn miles easily and consistently.

Instead of dealing with complicated bonus categories like dining, groceries, or gas, it works with a simple rule:

you earn miles on almost every purchase you make.

This card is ideal for people who:

- Travel occasionally but want to earn miles all year.

- Don’t want to memorize category bonuses.

- Want to convert everyday spending into travel rewards.

- Want a mid-tier card with solid benefits and a reasonable annual fee.

In short, the Venture Rewards is great for everyday U.S. consumers who use credit cards often and want simple rewards that turn into real value like trips or credits.

How the Rewards Program (Miles) Works

The Venture Rewards program revolves around miles. And the best part? You don’t need to be a miles expert to understand it. The rule is simple:

use the card → earn miles → redeem as you prefer.

How You Earn Miles

- 2 miles per dollar spent on nearly every purchase.

- Bonus miles for hotel and rental car bookings made through

Capital One Travel.

There are no complicated categories — everything earns miles at a consistent rate.

How You Can Redeem Your Miles

- Erase past travel purchases using the “Travel Eraser.”

- Book flights, hotels, and rental cars directly through Capital One Travel.

- Transfer miles to airline and hotel partners, including international programs.

In many cases, transferring to partners gives you even more value depending on the redemption.

Do Miles Expire?

As long as your account remains open and in good standing, your miles do not expire.

Top Benefits of the Capital One Venture Rewards

Now let’s talk about what makes this card so popular. The Venture Rewards offers a strong mix of benefits, especially for travelers, without overwhelming you.

1. Simple and Consistent Earning

2 miles per dollar — no categories, no headaches.

2. TSA PreCheck or Global Entry Credit

The card reimburses up to a set amount every few years for programs like TSA PreCheck or Global Entry,

which saves time and stress at the airport.

3. No Foreign Transaction Fees

A huge advantage: the Venture Rewards charges 0% foreign transaction fees. While many cards charge around 3% abroad, this one doesn’t.

4. Travel Protections

- Rental car insurance (secondary coverage in many cases).

- Emergency travel assistance.

- Lost or damaged baggage coverage (within benefit limits).

5. Purchase Protections

- Coverage for stolen or damaged purchases within a set timeframe.

- Extended warranty on eligible products.

- Help with disputed charges.

Fees and Costs of the Capital One Venture Rewards

Before choosing any card, you should fully understand the fees. The Venture Rewards has costs similar to most mid-tier travel cards.

- Annual fee: moderate yearly cost.

- APR: high and variable, like most credit cards in the U.S.

- Cash advance fee: high interest + fee per withdrawal.

- Late fee: charged if you miss a payment.

- Foreign transaction fee: 0%.

In short: this card is excellent as long as you don’t go into debt with it.

Is It Good for International Travel?

Traveling abroad can get expensive fast, but the Capital One Venture Rewards makes the process a lot easier.

When it comes to international use, this card truly shines — offering convenience, savings, and protections that most travelers appreciate.

It’s one of the main reasons so many people choose it as their go-to travel card.

Why It Works So Well for Travel

- No foreign transaction fees.

- High global acceptance (Visa or Mastercard).

- Consistent mile earning anywhere in the world.

- Useful travel protections.

- Easy use of miles to erase travel expenses.

Is the Capital One Venture Rewards Worth It?

Deciding if the Capital One Venture Rewards is worth it comes down to your lifestyle.

For many everyday Americans, it delivers one of the best value-for-money combinations in its category — simple rewards, solid travel perks, and an affordable annual fee.

But like any card, it’s a better fit for some people than others.

Great for People Who:

- Travel at least once a year.

- Want simple, automatic mile earning.

- Want solid benefits without a huge annual fee.

- Always pay their balance in full.

Not Ideal for People Who:

- Rarely travel.

- Carry balances or struggle with late payments.

- Want ultra-premium luxury perks.

The Capital One Venture Rewards is a solid choice if you want simple rewards, real value, and no foreign transaction fees, especially for travel.

If you use your card often, like to earn miles without overthinking, and want a card that “just works”, this one can fit your lifestyle really well.

Now that you know how it works, its pros and cons, you can decide if it’s the right travel partner for your wallet. For muita gente, it’s a smart and convenient option.