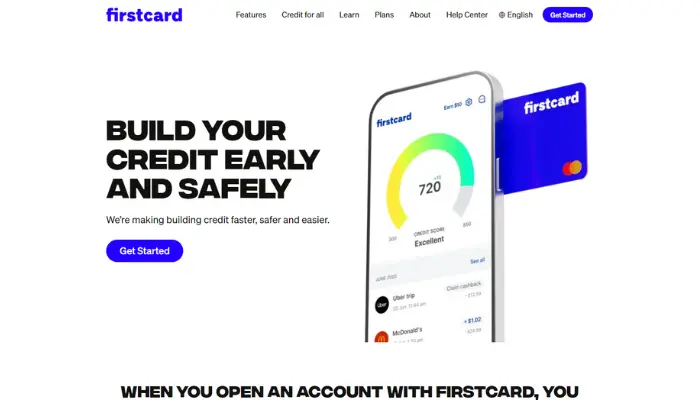

Is the Firstcard® Secured Credit Builder Worth It? Find Out Here!

If you are in the United States and want to improve your credit, you’ve probably heard of the Firstcard® Secured Credit Builder.

Advertisement

But what exactly is this card? How does it work? And is it the right choice for you? In this article, we’ll explain everything in a simple and straightforward way, no fluff. Let’s get started?

Advertisement

What is the Firstcard® Secured Credit Builder?

The Firstcard® Secured Credit Builder is a secured credit card designed especially for those who want to build or rebuild their credit history.

Unlike a regular credit card, it requires a security deposit, which becomes your credit limit.

Advertisement

In other words, you only spend what you already have saved, but with the advantage that your payments are reported to credit bureaus, helping to improve your score.

It’s perfect for those who:

- Have never had a credit card before.

- Are starting their financial life in the U.S.

- Have had problems in the past and want to turn things around.

How Does the Firstcard® Secured Credit Builder Work?

Let’s break it down once and for all! The Firstcard® Secured Credit Builder is a secured credit card, and the cool thing about it is that it was designed to be simple and accessible, even for those who don’t know much about finances.

But, of course, like any card, it has its details that you need to know to use it in the best way possible.

Here’s a super practical step-by-step guide to help you understand exactly how it works and how it can help you improve your credit:

Step by Step: How to Use the Firstcard® Secured Credit Builder

- Sign Up: You register online, providing basic information such as your name, address, and SSN (Social Security Number).

- Make the Security Deposit: This amount will define your credit limit. For example, if you deposit $200, that will be your limit.

- Use the Card Wisely: Buy everyday items and pay your bill on time. This shows that you are financially responsible.

- Credit Reporting: Firstcard reports your payments to credit bureaus (Equifax, Experian, and TransUnion), helping to improve your score.

- Get Your Deposit Back: When you close the account or upgrade to an unsecured card, the deposit is refunded (as long as you are up to date with your payments).

Advantages of the Firstcard® Secured Credit Builder

Why is the Firstcard® Secured Credit Builder one of the best choices for those looking to build or rebuild their credit?

Simple: it was designed to be accessible, practical, and efficient, especially for those who are starting or restarting their financial life in the U.S.

If you’re tired of being denied traditional credit cards or want a tool that truly helps you improve your score, the Firstcard might be the solution you’re looking for.

Here are some reasons that make it such a beneficial option:

- Easy Approval: Since you make a security deposit, the risk for the company is lower. This means that even those with a low score or no credit history can be approved.

- Credit Building: Your payments are reported to credit bureaus, which helps increase your score over time.

- Flexible Credit Limit: The limit is defined by the amount you deposit, but you can increase the deposit (and the limit) if needed.

- No Credit Check: This is great for those who have had issues in the past and want a fresh start.

Let’s dive into these benefits and see how they can make a difference in your financial life!

Disadvantages or Things to Watch Out For

Before diving headfirst into the Firstcard® Secured Credit Builder, it’s important to understand that, like any financial product, it has its points of attention.

Not everything is perfect, and knowing these disadvantages can help you make a more informed decision and avoid unpleasant surprises in the future.

Here are some details you need to keep an eye on:

- Initial Deposit: You need to have some money saved up for the security deposit.

- Fees: Some secured cards charge annual or maintenance fees. Check if the Firstcard has any of these fees before signing up.

- Credit Limit: Since the limit is equal to your deposit, it may be low at first, which limits your spending.

How Does the Firstcard® Secured Credit Builder Help Improve Your Credit Score?

Here’s the secret to boosting your credit: the Firstcard® Secured Credit Builder is a powerful tool, but it only works if you know how to use it correctly.

It was designed to help people like you build or rebuild a solid credit history, and the best part is that it does so in a simple and effective way. But how exactly does it work? Let us explain everything!

How Does the Firstcard Help Increase Your Score?

1. On-Time Payments:

The first step to improving your score is never missing a payment. When you pay your Firstcard bill on time and in full every month, it shows credit bureaus that you are reliable and know how to manage your finances. Every on-time payment is a point in your favor!

2. Responsible Credit Limit Usage:

Another golden tip is not to max out your card. Ideally, you should use less than 30% of your available limit.

For example, if your limit is $200, try to spend no more than $60 per month. This shows that you can control your spending and don’t rely on credit for everything.

3. Monthly Reporting to Credit Bureaus:

Here’s the game-changer! Firstcard sends information about your payments to the three major U.S. credit bureaus: Equifax, Experian, and TransUnion.

This means that every on-time payment and every responsible use of the card is recorded and helps increase your score over time.

Improving your credit score doesn’t happen overnight, but with patience and consistency, the results will show.

In just a few months, you may already see significant improvement, especially if you follow these tips closely.

Remember: credit is a marathon, not a 100-meter race!

Step by Step Guide to Sign Up for the Firstcard® Secured Credit Builder

Ready to take the first step and start building or rebuilding your credit with the Firstcard® Secured Credit Builder?

The good news is that the application process is simple, fast, and 100% online. To help you out, I’ve prepared a detailed step-by-step guide so you won’t have any doubts when signing up. Let’s get started?

Here’s everything you need to do, from signing up to receiving your card at home:

- Visit the Official Website: Go to the Firstcard website and click on “Apply Now.”

- Fill Out the Form: Provide your personal information, such as your name, address, and SSN.

- Choose the Deposit Amount: Decide how much you want to deposit (this will be your credit limit).

- Submit Required Documents: You may need to submit proof of identity and residence.

- Wait for Approval: Within a few days, you’ll receive your card at home.

If you’re struggling to improve your credit or starting from scratch, the Firstcard® Secured Credit Builder might be the solution you need.

It’s easy to get, helps you build your credit history, and over time, it can open doors to better financial opportunities.

Of course, it’s important to use the card responsibly: pay your bills on time, avoid overspending, and track your progress.

With patience and discipline, you’ll see your score rise and your financial options expand!

So, are you ready to take the first step? Visit the Firstcard website and start building a stronger financial future today!