U.S. Bank Cash+® Secured Visa®: Easy Approval & Requirements

If you are trying to build or rebuild your credit in the U.S., finding the right card can be challenging. But what if there was a card that not only helped improve your score but also offered cashback on your daily purchases?

Advertisement

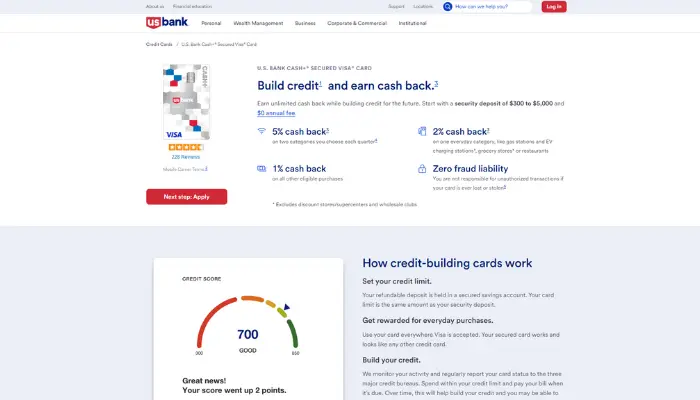

The U.S. Bank Cash+® Secured Visa® is one of the best secured credit cards on the market for those looking to increase their credit score while earning rewards. It allows you to choose your cashback categories and has no annual fee, making it an attractive option.

Advertisement

If you want to know how it works, how to apply, and whether it’s worth it for you, keep reading this article. We’ll explain everything in a simple and straightforward way!

What is the U.S. Bank Cash+® Secured Visa®?

The U.S. Bank Cash+® Secured Visa® is a secured credit card, which means it requires a security deposit for approval. This deposit acts as collateral and determines your credit limit.

Advertisement

It is designed for individuals who need to build or rebuild their credit. Unlike other secured cards that don’t offer rewards, this card provides cashback, allowing you to earn money back while improving your credit history.

Key Features

- Secured Card – Requires an initial deposit.

- Helps Build Credit – Reports your payments to the three major credit bureaus (Experian, Equifax, and TransUnion).

- Customizable Cashback – Choose the categories that best fit your lifestyle.

- No Annual Fee – Unlike many secured cards, it does not charge an annual fee.

If you have tried to get a traditional credit card and were denied, the U.S. Bank Cash+® Secured Visa® might be the perfect solution to start your journey toward a strong credit history.

How Does the U.S. Bank Cash+® Secured Visa® Work?

The U.S. Bank Cash+® Secured Visa® is an excellent choice for those looking to build or rebuild credit in the U.S. Since it is a secured card, you need to make a security deposit, which will determine your credit limit.

The main advantage is that, even though it is a secured card, it works like a regular credit card: you can make purchases, pay bills, and earn cashback.

Additionally, your payments are reported to the three major credit bureaus, helping to improve your score over time.

Here’s how it works step by step:

- Initial Deposit – You deposit an amount between $300 and $5,000. This will be your credit limit.

- Regular Card Use – Make purchases, pay bills, and use the card like any other credit card.

- Monthly Payments – You receive a statement every month and need to pay it to avoid high interest charges.

- Reports to Credit Bureaus – The bank reports your payments to Experian, Equifax, and TransUnion, helping to build your credit.

- Potential Upgrade – After demonstrating responsible financial behavior, you may qualify for an unsecured credit card and receive your deposit back.

If you pay everything on time and keep your balance low, your credit score can start improving quickly!

Main Benefits of the U.S. Bank Cash+® Secured Visa®

The biggest advantage of the U.S. Bank Cash+® Secured Visa® is that it offers cashback, a rare benefit among secured cards. While many secured cards only help build credit, this one allows you to earn money back on your daily purchases.

Here’s how the rewards program works:

- 5% cashback on two categories of your choice (up to $2,000 per quarter).

- 2% cashback on one fixed category (such as grocery stores, restaurants, or gas stations).

- 1% cashback on all other purchases.

This means that, in addition to improving your credit, you can also save money by using the card strategically for your daily expenses.

Who Can Apply for the U.S. Bank Cash+® Secured Visa®?

The U.S. Bank Cash+® Secured Visa® is designed for individuals with little or no credit history in the U.S. who need a reliable way to start or rebuild their credit score.

If you have tried applying for a traditional credit card and were denied, this could be an excellent alternative. Since it requires a security deposit, approval chances are higher, even for those without an established credit history.

Additionally, it can be a good option for immigrants, students, or anyone who needs to strengthen their financial history in the U.S.

To be approved, you must meet the following requirements:

- Be at least 18 years old and have a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Make an initial security deposit of at least $300.

- Have no recent bankruptcies on your financial record.

If you have recently moved to the U.S. or need to rebuild your credit, this card can be an excellent choice!

How to Apply for the U.S. Bank Cash+® Secured Visa®?

If you’re looking for a card that helps build credit and also offers cashback, the U.S. Bank Cash+® Secured Visa® might be the right choice. The application process is simple and can be completed entirely online, hassle-free.

Since this is a secured card, you will need to make a security deposit to set your credit limit.

Once approved, U.S. Bank will issue your card and start reporting your payment history to the major credit bureaus, helping strengthen your credit score over time.

Follow the step-by-step guide to apply:

- Visit the official U.S. Bank website and go to the Cash+ Secured Visa page.

- Fill out the online application with your personal and financial details.

- Choose the amount of your security deposit (minimum of $300).

- Submit the application and wait for approval.

If approved, your card will arrive in the mail within a few days.

Fees and Charges

Before applying for any credit card, it is essential to understand the fees involved to avoid surprises.

The U.S. Bank Cash+® Secured Visa® is one of the few secured cards that does not charge an annual fee, making it a great option for those looking for an affordable way to build credit.

Here are the main fees you should consider:

- Annual fee: $0

- Initial deposit: Minimum of $300 (the deposit amount determines your credit limit)

- APR for purchases: 29.24% variable

- Foreign transaction fee: 3%

If you pay your statement in full every month, you won’t have to worry about high interest rates. Like any credit card, it’s best to maintain good financial control and avoid carrying a balance to the next month, ensuring that the card helps strengthen your credit without generating unnecessary debt.

How to Improve Your Credit with This Card?

If your goal in obtaining the U.S. Bank Cash+® Secured Visa® is to build or rebuild your credit, using it correctly is essential.

Since the bank reports your payment history to the three major credit bureaus, your financial behavior can directly impact your credit score—either positively or negatively.

Here are some strategies to ensure your credit improves consistently:

- Always pay your bill on time – Late payments can negatively impact your score and lead to unnecessary interest charges.

- Keep card usage below 30% of your limit – If your credit limit is $1,000, try to keep your balance below $300 to demonstrate responsible use.

- Avoid paying only the minimum amount – Whenever possible, pay off the full statement balance to avoid high interest and maintain a healthy credit history.

By following these practices, you may see an improvement in your credit score within a few months, increasing your chances of securing better credit opportunities in the future.

If you want to build credit and earn cashback at the same time, the U.S. Bank Cash+® Secured Visa® is one of the best options available.

With solid benefits and no annual fee, it is a smart choice for those looking to achieve a better financial future in the U.S.!