Bank of America Technological Equipment Financing

If you’re a business owner or just starting a company, you know that technology isn’t a luxury—it’s a necessity. Whether it’s a high-end computer, an industrial machine, or even specific tech tools, all of this comes at a cost.

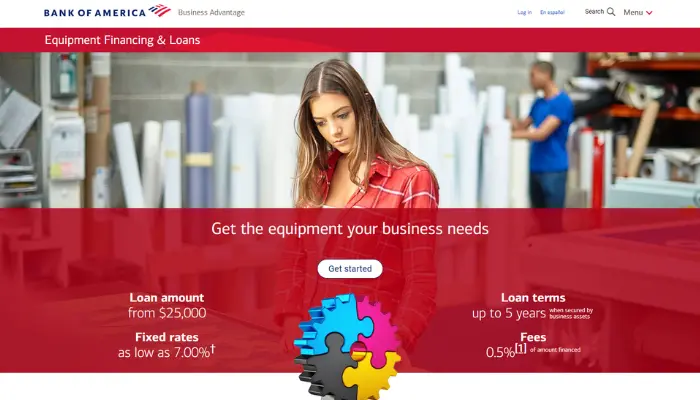

Advertisement

That’s where the Bank of America’s financing for technological equipment comes in: a practical solution so you don’t have to spend all your money at once.

Advertisement

In this article, we’ll explain everything about how this type of financing works, why you should choose Bank of America, the benefits, and even some tips to get the best deal. Let’s dive in!

What is Financing for Technological Equipment?

Simply put, financing for technological equipment is when you borrow money to buy tech equipment and pay it off over time, with interest, of course. This helps your business stay updated without draining your cash flow.

Advertisement

Imagine you need new computers or a modern machine to increase production. Financing gives you the money to buy this equipment now, and you pay it back in installments over an agreed period. Simple, right?

In the case of Bank of America, they offer both traditional financing and leasing (I’ll explain more about that later), giving you great flexibility to choose what fits your budget best.

Why Choose Bank of America?

Bank of America isn’t just any bank. We’re talking about one of the largest financial institutions in the world, with decades of experience helping businesses of all sizes.

Their big differentiator is that they don’t just provide the money but also offer support to help you understand the best type of financing for your business.

And if you’re just starting out and think, “This won’t work for me,” don’t worry! They have options that cater to small businesses as well as large enterprises.

On top of that, Bank of America is known for offering competitive rates and flexible payment terms. In other words, they’re reliable and help you save money too.

How Does Financing for Technological Equipment Work?

If you think financing technological equipment might be complicated, don’t worry! Bank of America makes the process super simple so you can get what you need without any hassle.

Their goal is to make everything as straightforward and accessible as possible, whether you’re running a small business or leading a large enterprise.

Here’s a step-by-step guide to help you understand how everything works, from deciding what you need to purchasing the equipment.

Spoiler: it’s easier than it looks!

- Credit Evaluation: They review your financial history. This includes your business credit or, in some cases, your personal credit if your business doesn’t have much credit history yet.

- Equipment Selection: You need to know what you want to purchase. It can be anything in the technological category, as long as it makes sense for your business.

- Proposal Submission: After evaluating your credit, the bank provides you with a proposal outlining the financing terms: amount, duration, and interest rates.

- Contract Signing: If you agree to the terms, you sign the contract and initiate the process to release the funds.

- Purchase and Payment: The bank releases the funds, and you purchase the equipment. Then, you simply follow the agreed payment schedule.

Benefits of Financing with Bank of America

Now that you understand how financing works, let’s dive into the most interesting part: the benefits that make Bank of America a smart choice. Why should you pick this bank to finance the equipment your business needs?

Beyond offering accessible conditions, Bank of America combines convenience, security, and expert support to help you make strategic financial decisions.

Let’s break down the key reasons why this financing is worth it!

- Competitive Rates: Interest rates are often lower than credit cards or other loan options.

- Flexible Terms: You can negotiate repayment schedules that fit your business budget.

- Capital Preservation: You don’t need to spend all your company’s money at once. This leaves funds available for other important expenses.

- Expert Support: They have consultants who help you make the best decisions. It’s not just about giving you money and leaving you on your own.

- Credibility: As a large and reliable bank, you don’t have to worry about scams or financial issues.

Who Can Apply for Financing?

Bank of America’s financing isn’t just for big corporations. Small businesses, startups, and even self-employed individuals with a business entity can apply.

Of course, to qualify, you’ll need to meet some basic requirements:

- Have a good credit history (business or personal).

- Provide documents such as financial statements and a business plan, depending on the size of your company.

- Show that the equipment you want to finance makes sense for your business operations.

Key Equipment That Can Be Financed

If you’re considering financing technological equipment for your business, you might be wondering: what does Bank of America specialize in?

Besides simplifying the process, the bank offers various advantages that help you save money while keeping your business finances organized.

From competitive interest rates to repayment terms that fit your budget, Bank of America stands out by offering practical and tailored solutions.

Let’s explore the types of equipment that can be financed:

- IT Equipment: Computers, laptops, servers, and expensive software.

- Industrial Machinery: Modern machines for factories and production lines.

- Automation Tools: Robots, sensors, and other automation equipment.

- Medical Equipment: Exam machines, laboratory tools, and more.

Bank of America is quite flexible in this area, so if you have specific equipment in mind, it’s worth reaching out to discuss your options.

Difference Between Financing and Leasing at Bank of America

When it comes to acquiring technological equipment, many people confuse financing with leasing. Although both are useful options, they have important differences that can influence your decision based on your business needs.

- Financing: You borrow money and purchase the equipment, which becomes yours from the start.

- Leasing: It works like a rental. You use the equipment, but it remains the property of the bank or leasing company until you decide to buy it outright or return it.

If your goal is a long-term commitment, financing is often the better choice. On the other hand, leasing is ideal if you want to test the equipment before buying or aren’t sure about its long-term use.

Understanding these differences is key to making the best decision!

Practical Examples: How Companies Use Financing

If it’s still not clear how financing can transform a business’s daily operations, here are some practical examples.

These cases show how different types of companies grow, optimize processes, and even attract more clients by leveraging Bank of America’s financial support.

- Tech Startup: A startup uses financing to purchase powerful servers and expand its cloud services. This allows them to serve more clients and grow quickly.

- Medical Clinic: A clinic finances modern ultrasound machines, offering more accurate exams and attracting new patients.

- Food Factory: A factory invests in automated machinery, reducing production costs and increasing profits.

These examples show how financing can be a game-changer for businesses looking to grow.

Tips to Get the Best Financing Plan

Getting a good financing plan isn’t just about filling out forms and waiting for approval. It’s about being prepared and making strategic decisions that ensure the best conditions for your business.

With a few simple actions, you can increase your chances of securing lower interest rates, more comfortable repayment terms, and greater confidence from the bank.

Here are some valuable tips to help you get organized and negotiate like a pro!

- Organize Your Finances: Before applying for financing, maintain detailed financial records. Show that your business is reliable.

- Research Rates: Compare interest rates and make sure Bank of America offers the best terms for you.

- Negotiate Terms: If the initial repayment schedule doesn’t work for you, try negotiating. Banks are often flexible.

- Improve Your Credit: If possible, pay off debts before applying for financing. A good credit history makes a big difference.

- Consult an Expert: If you’re unsure, talk to a bank consultant or someone who understands the process.

Are interest rates high?

No, interest rates are generally very competitive. However, the exact rate will depend on your credit history and the financial analysis conducted by the bank.

Can I finance used equipment?

Yes, in some cases, financing for used equipment is possible. However, it must be in good condition and essential for your business operations. Check with the bank to confirm if the equipment meets their criteria.

How long does approval take?

Approval is usually fast, especially if you have all your documents organized. The exact time frame will depend on your credit analysis and the complexity of your application.

Financing technological equipment through Bank of America could be the solution your business needs to grow and stay competitive. With great rates, flexible terms, and top-notch support, it’s an option worth considering.

So, if you’re thinking about upgrading your technology, don’t wait. Get in touch with Bank of America and take the next step for your business!