US Bank Secured Credit Card: Your Complete Guide to Building Credit in 2026

Look, we get it. Dealing with credit stuff can feel like trying to read a foreign language. Banks love throwing around fancy terms that make your head spin. But here’s the thing: building good credit doesn’t have to be complicated, and the US Bank Secured Credit Card might be exactly what you need to get started or bounce back from tough times.

Advertisement

Maybe you’re just starting out and nobody will give you a chance. Maybe life happened and your credit took a hit. Whatever your story is, you’re not alone. Millions of Americans are in the same boat, and secured credit cards exist specifically to help people like us get back on track. So let’s break down everything about the US Bank Secured Card in plain English, no BS.

Advertisement

What Exactly is the US Bank Secured Credit Card?

Alright, let’s start with the basics. A secured credit card is basically a credit card with training wheels. You put down some money upfront (called a security deposit), and that money becomes your credit limit. So if you deposit $500, you can spend up to $500. The bank holds onto your deposit as a safety net in case you can’t pay your bill.

The cool part? This card works exactly like a regular credit card. You can use it anywhere Visa is accepted, which is pretty much everywhere. The cashier at Target, the gas station, online shopping – nobody can tell the difference between your secured card and some fancy platinum card. It looks the same, works the same, and most importantly, it builds your credit the same way.

Advertisement

US Bank reports your payment activity to all three major credit bureaus every single month. That means every time you pay your bill on time, you’re basically adding gold stars to your credit report. Do this consistently for a while, and you’ll watch your credit score climb up. That’s the whole point of this thing.

The Three US Bank Secured Card Options (Pick Your Fighter)

Here’s something pretty awesome about US Bank: they don’t just have one boring secured card. They actually give you three different options depending on what matters most to you. Some folks just want something simple, others want to earn rewards while they build credit. Let’s break down each one so you can figure out which one fits your life.

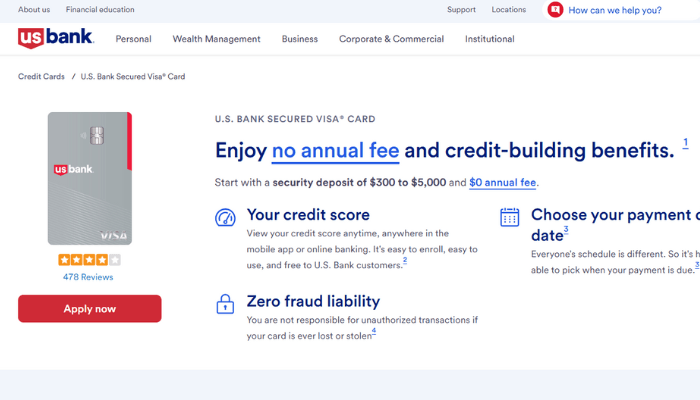

US Bank Secured Visa Card (The No-Frills Option)

This is the basic model, and honestly, there’s nothing wrong with keeping it simple. No annual fee, deposit between $300 and $5,000, and your money sits in a savings account that actually earns interest.

Yep, while your deposit is chilling at the bank, it’s making you a little extra cash. Not many secured cards do that. The downside? No rewards program. But if you’re just focused on building credit without any extra complications, this one gets the job done.

US Bank Cash+ Visa Secured Card (The Money-Back Machine)

Now we’re talking! Same deal with no annual fee and the $300 to $5,000 deposit range, but this bad boy gives you cash back. We’re talking 5% back on the first $2,000 you spend each quarter in two categories YOU pick.

Could be gas stations, grocery stores, fast food, streaming services, whatever works for your life. You also get 2% back on one everyday category and 1% on everything else. If you’re going to spend money anyway, might as well get some of it back, right?

US Bank Altitude Go Secured Visa Card (For the Foodies)

If you eat out a lot or love your delivery apps, this card was basically made for you. You’ll earn 4X points on dining, takeout, and food delivery on your first $2,000 each quarter. That’s huge. Plus 2X points on groceries, gas stations, EV charging, and streaming services. And here’s a sweet bonus: after 11 months of paying for streaming services with this card, you get a $15 credit. It’s like Netflix paying you back a little. No annual fee either.

Can You Actually Get Approved? (Real Talk About Requirements)

This is where a lot of people stress out, so let’s clear the air. Secured cards exist for people who have trouble getting approved for regular cards. That’s literally their purpose. So the requirements are way more relaxed than you might think.

For the basic Secured Visa and the Cash+ Secured, US Bank accepts applicants with credit scores as low as 300. Yeah, you read that right. Pretty much rock bottom, and you still have a shot. The Altitude Go Secured needs a slightly better score around 640, but that’s still in the “fair credit” range that a lot of us fall into.

Now here’s the real talk: just because they accept low scores doesn’t mean approval is guaranteed. Banks look at the whole picture, including your income, existing debts, and whether you’ve got any bankruptcies or serious issues on your record. But compared to trying to get a regular credit card with bad credit? Your odds here are WAY better.

How to Apply for the US Bank Secured Card (Step-by-Step)

Ready to pull the trigger? The application process is pretty straightforward and you can do it from your couch. Here’s exactly how it works:

- Go to usbank.com and find the Secured Credit Card page. Pick which of the three cards you want to apply for.

- Click “Apply Now” and fill out your personal info. They’ll ask for your name, address, Social Security number, date of birth, and how much money you make.

- Wait for the decision. Most people get an answer within seconds. Sometimes they need to review it more, which can take a few days.

- If approved, your security deposit gets processed. They’ll pull it from the bank account you provided. Heads up: this sometimes happens before you even get the official approval letter, which can be confusing.

- Your card arrives in the mail. Usually takes about 7 to 10 business days. Activate it and you’re good to go.

Have your bank account info ready before you start. You’ll need it for the deposit, and stopping mid-application can sometimes cause issues.

The Security Deposit: Your Money Questions Answered

Let’s talk about that deposit because this is usually where people have the most questions. First thing to know: this is YOUR money. You’re not giving it away. Think of it more like putting money in a savings account that happens to let you have a credit card.

You can deposit anywhere from $300 to $5,000. Whatever amount you choose becomes your credit limit. So a $500 deposit means a $500 limit. The cool thing about US Bank is that $5,000 max is actually pretty generous.

A lot of other secured cards cap you at $1,000 or $2,000, which can be limiting if you’ve got the cash and want a higher limit for better credit utilization.

Your deposit goes into an FDIC-insured savings account, and here’s the kicker: it earns interest while it sits there. The bank doesn’t touch it as long as you keep your account in good standing.

When you eventually close the account or graduate to a regular card, you get every penny back plus whatever interest it earned.

After six months with a good payment history, you can even add more to your deposit to increase your credit limit, as long as you stay under that $5,000 ceiling. Best part? They usually don’t do a hard credit check for this, so it won’t ding your score.

Fees and Interest Rates (The Not-So-Fun But Important Stuff)

Nobody likes talking about fees and interest rates, but you gotta know what you’re getting into. The good news? US Bank Secured Cards have no annual fee. Zero. Zilch. That’s already better than some secured cards that charge you $25-50 a year just to have the card.

The APR (that’s the interest rate if you carry a balance) is around 28.24% variable. Yeah, that’s high, but honestly, that’s pretty standard for secured cards and even most regular credit cards these days. The key is to pay your balance in full every month so you never actually pay interest. Use the card, pay it off, repeat.

One really nice thing about US Bank: they don’t have a penalty APR. What’s that mean? Some credit card companies jack up your interest rate to like 30%+ if you pay late even once. US Bank doesn’t do that. You’ll still get hit with a late fee (up to $41), but your interest rate stays the same. That’s actually a big deal if you ever slip up.

If you’re planning to use the card internationally, heads up: there’s a 2-3% foreign transaction fee. So if you buy something for $100 while traveling abroad, you’ll actually pay $102-103. Not the end of the world, but worth knowing.

How to Graduate to a “Real” Credit Card (The Exit Strategy)

Here’s the light at the end of the tunnel: you’re not meant to have a secured card forever. The whole point is to build your credit and eventually “graduate” to a regular, unsecured credit card where you get your deposit back.

US Bank starts reviewing your account for potential graduation after 12 months. Some people report being able to request it as early as 6 months if their credit score hits around 650+ and they’ve paid on time every single month. When you graduate, your deposit comes back to you within one or two billing cycles, and your card gets upgraded to an unsecured version.

What You Need to Graduate

- Credit score around 650-680 or higher

- Perfect or near-perfect payment history (no late payments)

- Account in good standing (not over your limit)

- At least 6-12 months with the card

- If you had a bankruptcy, you might need to wait 5+ years (unfortunately)

Graduation isn’t always automatic. Some people have to actually call and ask for it. Don’t just sit around waiting. After a year of good behavior, call the number on the back of your card (800-285-8585) and ask if you’re eligible. The worst they can say is not yet.

Getting the card is just step one. What you do with it is what actually builds your credit. Here’s the playbook that works: