Wells Fargo Reflect 0% APR Guide

When you’re trying to save money, avoid interest, or get your credit under control, the right credit card can make all the difference. One option that stands out for low interest and balance transfers is the Wells Fargo Reflect® Card.

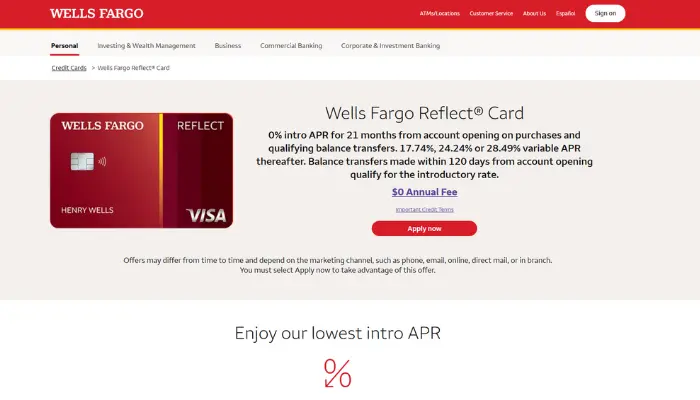

Advertisement

It’s known for offering one of the longest 0% APR periods on the market, giving everyday Americans extra time to handle bills, big purchases, or existing debt.

Advertisement

In this article, you’ll see how the Wells Fargo Reflect® Card works, who it’s for, the fees involved, how to apply, and whether it fits your financial goals.

How to Apply for the Wells Fargo Reflect® Card

If you are thinking about getting the Wells Fargo Reflect® Card, the good news is that the application process is simple and usually done completely online.

Advertisement

As long as your credit profile is in decent shape, you can often get a decision in just a few minutes.

Before you apply, it is important to know what the bank will ask for and what they look at when deciding whether to approve you.

Here is a step-by-step guide to make everything easier.

Step-by-step: How to apply

- 1. Go to the official Wells Fargo website.

On the credit card section, look for the Wells Fargo Reflect® Card and click on the “Apply Now” button. - 2. Fill in your personal information.

You will need to provide your full name, address, date of birth, and Social Security Number. - 3. Enter your income details.

The bank uses your income to estimate how much credit limit they can offer you. - 4. Confirm your identity.

Sometimes the bank may ask a few extra questions or verification steps to confirm it is really you. - 5. Submit your application and wait for the decision.

In many cases, the decision is instant. In some situations, it can take a little longer if they need to review your file. - 6. If approved, wait for the card to arrive.

Your physical card usually arrives by mail in a few business days. Then you can activate it online, in the app, or by phone.

Tips to improve your approval chances

- Try to keep your credit score in at least the “good” range (around 670 or higher).

- Pay down recent credit card balances before applying.

- Avoid applying for several different credit cards in the same month.

- Check your credit report for errors and dispute anything that is wrong.

What Is the Wells Fargo Reflect® Card?

The Wells Fargo Reflect® Card is a credit card designed for people who want to save on interest, especially on big purchases or existing debt.

Unlike many cards on the market, this one does not focus on rewards, points, or cashback. Its main mission is simple: give you as much time as possible with 0% APR.

In other words, the card is built for someone who wants a long interest-free period to organize their finances, pay off balance transfers, or handle an important purchase without being crushed by interest.

It runs on a major network (such as Visa), which means it is widely accepted at most merchants in the United States and abroad.

If you are chasing miles, lounge access, and luxury perks, this is not the card for that. But if your focus is lower costs and financial breathing room, the Wells Fargo Reflect® Card fits perfectly.

Who Is the Wells Fargo Reflect® Card Best For?

Not every card works for every person. The Wells Fargo Reflect® Card is better for people who care more about paying less interest than collecting rewards.

Think of it as a tool to fix your finances or to handle expensive moments in life with more control.

This card is especially good for:

- People with existing credit card debt.

If you are paying high interest on another card, the Reflect can help through a balance transfer with 0% APR for a promotional period. - Big planned purchases.

Buying a new phone, laptop, mattress, furniture, or home appliances is easier to manage when you have months of no interest to pay it off. - People who want a simple, no-annual-fee card.

There is no annual fee, and no complicated rewards system to track. - Those who are improving their credit profile.

If your score is not perfect but is on the right path, this card can help as long as you use it responsibly and pay on time.

Main Benefits of the Wells Fargo Reflect® Card

What makes this card stand out is not a long list of luxury perks, but a few key benefits that are very valuable for the average person.

If your goal is to save money and reduce stress around interest charges, these features matter much more than rewards programs.

Key advantages

- Very long 0% APR period on purchases and balance transfers.

This is the big highlight. You get a long window where you do not pay interest, as long as you pay at least the minimum on time every month. - No annual fee.

You do not pay just to keep the card open, which is great for simple, long-term use. - Zero Liability Protection.

If someone makes unauthorized purchases with your card, you are not held responsible for those charges when you report it. - Solid mobile app and online banking.

You can manage everything from your phone: payments, alerts, balance, and spending tracking. - Budgeting and control tools.

The Wells Fargo platform offers alerts and features that help you stay on top of due dates and avoid late payments.

Wells Fargo Reflect® APR: Interest, Rates, and Conditions

APR is where a lot of people get confused, but it is one of the most important things to understand before you apply for any card.

The Wells Fargo Reflect® Card offers a strong promotional APR, but like most cards, the regular APR after that can be high if you carry a balance.

How APR generally works on this card

- Introductory APR: 0% for a promotional period on purchases and qualifying balance transfers.

- Regular APR: After the promo period ends, a standard variable APR applies based on your credit profile.

- Cash advance APR: Usually much higher than the APR for purchases, plus an additional fee.

- Penalty risk: Late payments may affect your promo benefits and your credit profile.

A simple way to think about it: the card gives you a long break from interest, but it is up to you to use that time wisely.

If you keep a balance after the promotional period, regular interest kicks in and can become expensive.

How the 0% APR on the Wells Fargo Reflect® Card Works

The 0% APR offer is the main reason people search for this card. It can apply to both new purchases and balance transfers, but it has rules and a time limit.

To really take advantage of it, you need a plan before you start swiping the card.

How to use the 0% APR benefit the smart way

- Focus on big, necessary purchases that you can pay off before the promo period ends.

- If you do a balance transfer, try to move all the high-interest debt at the beginning of the promo window.

- Always pay at least the minimum payment on time to keep the offer valid.

- Divide the total amount you owe by the number of promo months and treat that as your target monthly payment.

This is not free money; it is a temporary opportunity to get organized.

If you are disciplined, you can save a lot on interest compared to carrying debt on a card with a normal APR.

Balance Transfers with the Wells Fargo Reflect® Card

If you have other credit cards charging high interest, a balance transfer to the Wells Fargo Reflect® Card can be a powerful way to lower your costs.

Instead of paying 20% or more on another card, you can move that balance and enjoy a long period with 0% APR, which makes it much easier to pay down the principal.

How to request a balance transfer

- 1. Log in to your Wells Fargo online account or app.

Look for the option for “Balance Transfer” or similar wording. - 2. Enter the details of your old card.

You will need the account number and the amount you want to transfer. - 3. Choose the transfer amount.

You can transfer part or all of the existing balance, depending on your new credit limit. - 4. Submit the request.

Wells Fargo will process the transfer and send payment to your other card issuer. - 5. Keep an eye on both accounts.

Make sure the old balance is paid off and that the transfer shows up correctly on your Reflect card.

Important things to keep in mind

- There is usually a balance transfer fee, which is a percentage of the amount transferred.

- Only transfer what you are confident you can pay off during the 0% APR period.

- Try not to keep using the old card, or you may end up in debt again.

Fees on the Wells Fargo Reflect® Card

One of the best parts of this card is the lack of an annual fee. However, like any credit card, there are other fees you should know about so there are no surprises later.

Main fees explained

- Annual fee: $0. You do not pay just for having the card.

- Balance transfer fee: A percentage of each transfer amount, charged when the transfer posts.

- Late payment fee: Charged if you miss the due date.

- Cash advance fee: Charged when you withdraw cash using the card, plus a high APR.

- Foreign transaction fee: Applied when you use the card for purchases outside the United States or in foreign currency.

If you do not use cash advances and stay on top of your due dates, you can keep your extra costs very low with this card.

Most people who use it wisely end up paying far less than they would on a typical high-interest credit card.

Approval Requirements: Credit Score and What the Bank Looks At

The Wells Fargo Reflect® Card is not a starter card for people with very poor credit, but it is also not only for perfect credit profiles.

It usually fits people who are in the “good” range and trying to manage their money more seriously.

What usually helps your approval chances

- Credit score: A score in the good range (around 670 or higher) tends to help.

- Stable income: Lenders want to see that you have the ability to repay what you borrow.

- Reasonable existing debt levels: High utilization of your current credit may count against you.

- On-time payment history: A record of paying on time is a big positive factor.

If you feel your profile is borderline, you can work on paying down debts, correcting errors in your credit report, and avoiding new credit applications for a while before applying.

Wells Fargo Reflect® App and Digital Features

In today’s world, no one wants a credit card that is hard to manage.

The Wells Fargo mobile app and online banking tools make it easy to stay on top of your balance, payments, and spending, which is especially important when you are trying to use a long 0% APR offer successfully.

What you can do in the app

- Check your real-time balance and available credit.

- Set up automatic payments or schedule one-time payments.

- Turn on alerts for due dates, large purchases, and unusual activity.

- Lock and unlock your card if it gets lost or if you see suspicious charges.

- Track your spending by category to better understand your habits.

Using these tools regularly helps you avoid late payments, which is critical if you want to maintain your 0% APR promotion and protect your credit score.

Is the Wells Fargo Reflect® Card Good for Everyday Use?

Whether this card works as your main everyday card depends on what you value more: rewards or savings on interest.

If you are looking for cashback, travel points, and perks, there are better options. But if your main goal is lower costs and debt control, the Reflect can be a strong everyday partner.

When it makes sense as a daily card

- You have big expenses to spread out over time without interest.

- You prefer a simple card with no annual fee and clear benefits.

- You are focused on paying off debt and not on collecting rewards.

When it is not the best choice

- You travel often and want travel protections and rewards.

- You always pay your balance in full and want cashback or points instead.

- You plan to use the card a lot outside the United States.

Is the Wells Fargo Reflect® Card Good for Travel?

The Wells Fargo Reflect® Card is not really a travel-focused credit card. It can technically be used abroad, but foreign transaction fees and the lack of travel perks make it less attractive for that purpose.

If you travel frequently, a dedicated travel rewards card with no foreign transaction fees will usually serve you better. The Reflect is more of a tool for domestic spending, balance transfers, and interest savings.

How to Improve Your Chances of Getting Approved

If you are worried about being denied, a few simple moves can significantly increase your chances of getting approved for the Wells Fargo Reflect® Card. Think of it as preparing your profile before walking into the bank, even if everything happens online.

Practical steps to take before applying

- Pay down existing credit card balances to lower your utilization.

- Make sure you have no recent late payments on your report.

- Stop applying for other cards or loans for a little while.

- Review your credit report for mistakes and dispute anything inaccurate.

- Have your income information ready and be honest when you fill out the application.

If your main goal is to save money on interest, pay off existing debt more comfortably, and get more control over your finances, the Wells Fargo Reflect® Card can be an excellent choice.

It does not try to be everything at once. Instead, it focuses on doing one thing very well: offering a long 0% APR period that helps real people handle real financial pressure.

It is not the best option for travel lovers or rewards hunters. But for anyone who wants a practical, no-annual-fee card that actually helps reduce financial stress, the Wells Fargo Reflect® Card definitely deserves a spot on your list of options to consider.