How to Apply for the Citi Double Cash

If you’ve been looking for a credit card that keeps things simple — no complicated rewards, no high annual fees, and no confusing fine print — the Citi Double Cash Card might be exactly what you need.

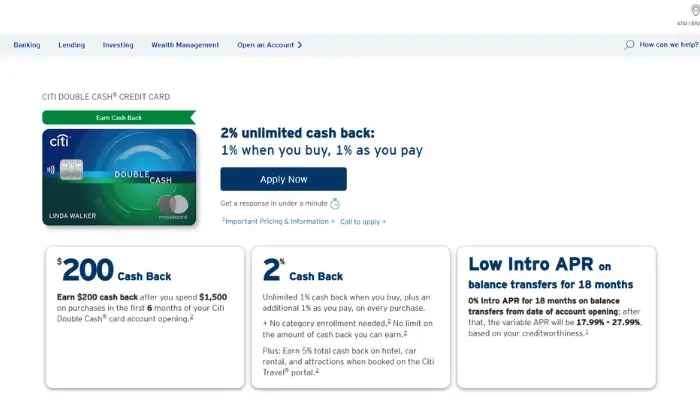

Advertisement

This card is super popular because of its straight-to-the-point rewards system: you earn 1% when you buy and another 1% when you pay it off. That’s a total of 2% cashback on every purchase, every time.

Advertisement

In this guide, we’ll break down everything you need to know before applying — from the requirements and benefits to the step-by-step application process and tips to get approved faster.

What Is the Citi Double Cash?

The Citi Double Cash Card is one of those no-nonsense credit cards that just works. It doesn’t give you points for weird categories or limit your rewards to grocery stores or gas stations — instead, you get cashback on everything you buy and pay for.

Advertisement

Here’s the deal: you get 1% cashback when you make a purchase, and another 1% when you pay it off. That’s it — no hoops, no hidden tricks.

It’s a Mastercard backed by Citibank, so it’s accepted almost everywhere in the U.S. and abroad. Plus, it has no annual fee, which makes it a solid pick if you don’t want to pay just to have a card in your wallet.

If your credit is in good shape and you want something reliable that rewards everyday spending — groceries, gas, bills, even your Netflix subscription — the Citi Double Cash is one of the best options out there.

Key Benefits

What makes the Citi Double Cash such a hit is how effortless it is. You don’t need to chase bonus categories or sign up for special promos — you just get rewarded for doing what you already do every day: buying stuff and paying it off.

It’s real cash back that keeps adding up, and that’s what makes this card stand out for everyday people who just want something simple and rewarding.

Here’s what makes it stand out:

- 2% total cashback (1% when you buy, 1% when you pay) — no caps or limits.

- No annual fee, ever.

- You can redeem cashback as statement credit, direct deposit, or convert it to ThankYou Points if you want to use it for travel or gift cards.

- Security and protection from Mastercard, including purchase protection and $0 fraud liability.

There’s nothing flashy about it — and that’s exactly why so many people trust it. You don’t have to memorize rotating categories or worry about spending limits. You just swipe, pay, and earn.

Requirements to Apply

Before hitting that “Apply Now” button, it’s smart to know if you’ll likely get approved. The Citi Double Cash isn’t a starter card — it’s meant for people with at least good credit.

Here’s a quick checklist of what you’ll usually need:

- Credit score: 670 or higher is recommended.

- Stable income: You don’t need to be rich, but you’ll need to show you can handle payments.

- U.S. address and Social Security Number (SSN): You must be a resident or citizen.

- Clean credit history: Too many late payments or recent hard inquiries might hurt your chances.

If your score is a bit below 670, it might still be worth trying if you’ve had a steady job and low debt. Citi sometimes approves applicants with fair credit if the rest of their profile looks solid.

How to Apply Online

Getting the Citi Double Cash Card is actually pretty simple — no need to visit a branch or talk to anyone on the phone. Everything can be done online, right from your computer or phone, in just a few minutes.

The key is to have your basic info ready so the process goes smoothly and you don’t waste time clicking back and forth.

Here’s a quick step-by-step to help you get it done fast:

- Go to Citi’s official website.

Head to www.citi.com and look for the Citi Double Cash Card page. - Click “Apply Now.”

The application form will open on a secure page. - Fill in your personal details.

You’ll need to provide:- Full name

- Address

- Date of birth

- Social Security Number (SSN)

- Annual income

- Employment status

- Review and submit your application.

Double-check everything — mistakes can slow down approval. - Wait for a decision.

Many applicants get an instant decision, but some might take up to 7–10 business days.

Once approved, your card usually arrives in 7 to 10 days by mail.

Application Tips

Even though applying for the Citi Double Cash Card is quick and easy, getting approved isn’t always automatic. A few smart moves before you hit “submit” can really boost your chances. Think of it as setting yourself up for success.

Here are some practical tips that can make a big difference:

- Check your credit score first. Make sure it’s in the “good” range (around 670 or higher). If it’s lower, take a few weeks to clean things up before applying.

- Pay down your existing balances. The less you owe, the better your credit utilization — and that’s something lenders always look at.

- Don’t apply for too many cards at once. Each application creates a “hard inquiry,” and too many of those in a short time can make banks nervous.

- Try Citi’s pre-approval tool. It’s a soft check that doesn’t hurt your score and shows if you’re likely to qualify.

Doing these small things before you apply can turn a borderline application into an easy approval. It’s all about showing the bank that you manage your credit responsibly.

Fees and APR

One of the biggest perks of the Citi Double Cash Card is that it doesn’t charge an annual fee, which already puts money back in your pocket. But like any credit card, there are still a few costs you should keep an eye on — especially if you don’t pay off your balance every month.

Knowing the fees upfront helps you avoid surprises later. Here’s a quick breakdown of what to expect:

- APR (interest rate): Usually between 19.24% and 29.24% variable, depending on your credit score.

- Balance transfer fee: 3% (or $5 minimum).

- Late payment fee: Up to $41 if you miss your due date.

- Foreign transaction fee: 3% of each purchase made outside the U.S.

The best way to keep this card truly free? Pay your full balance every month. That way, you get all your cashback rewards without losing a cent to interest.

Balance Transfer Option

One cool thing about the Citi Double Cash is that it can help you pay off debt cheaper. It often comes with a 0% intro APR for balance transfers for the first 18 months (check the current offer — it changes sometimes).

That means you can move high-interest balances from another card and pay them off with no interest during that period.

Just remember:

- There’s usually a 3% fee when you transfer.

- After the promo ends, the regular APR applies.

If you’re carrying expensive debt, this card can be a smart way to get breathing room and finally clear it out.

Common Reasons for Denial

Getting denied for a credit card can be frustrating, but it’s not the end of the world — and it doesn’t mean your credit is ruined. The truth is, even people with good credit sometimes get turned down. Lenders look at a lot more than just your score, and a few small things can make the difference between “approved” and “denied.”

Here are some of the most common reasons why Citi might decline an application:

- Credit score below 650.

- Too many recent credit applications.

- High balances on existing cards.

- Late or missed payments in your history.

- Incomplete or inconsistent information on your form.

If this happens, don’t stress. Citi will send you a letter explaining exactly why you weren’t approved. Once you know the reason, you can fix it — and try again when your profile looks stronger.

Is It Worth Applying?

If you’re the kind of person who just wants a card that rewards you for paying your bills on time, this one’s a winner.

Here’s who it’s great for:

- People who pay off their balance every month.

- Those who want cashback without any effort.

- Anyone tired of reward programs that change every quarter.

The Citi Double Cash isn’t perfect — it doesn’t have travel rewards or big sign-up bonuses — but that’s the trade-off for its simplicity and reliability.

If you’re focused on everyday spending and want something easy to manage, this card will fit right into your lifestyle.

The Citi Double Cash Card proves that sometimes, simple really is better. You don’t need to chase categories or memorize reward systems — just spend responsibly, pay on time, and enjoy your 2% back.

It’s one of those cards that quietly does its job, helping you save money with almost no effort.

So if you’re ready to earn cashback every day without dealing with confusing terms or fees, go ahead and apply. The process is quick, the approval chances are solid (if your credit is good), and the rewards are automatic.

You can apply directly through Citi’s official website and start earning cashback on your next purchase.